39 is service revenue an asset

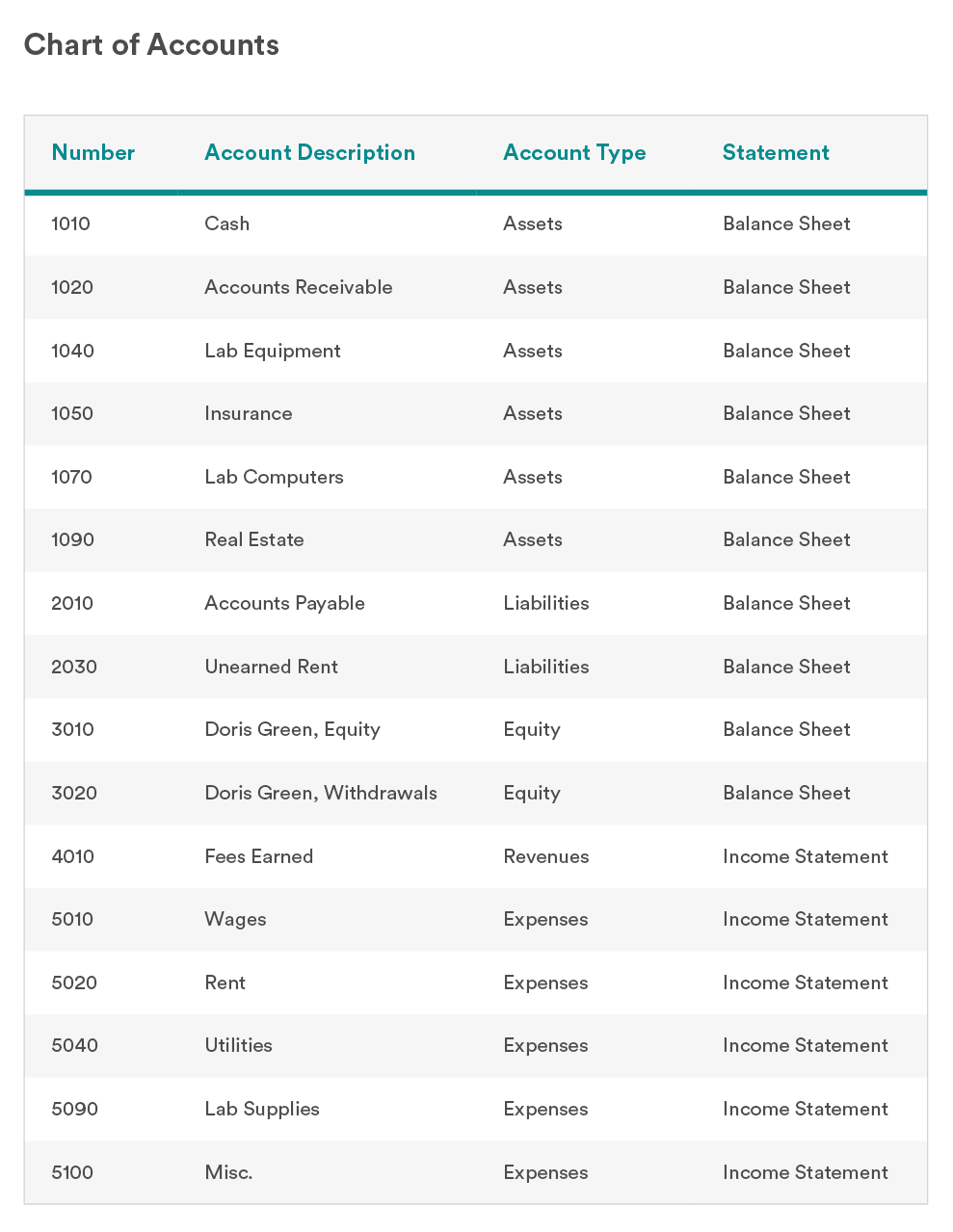

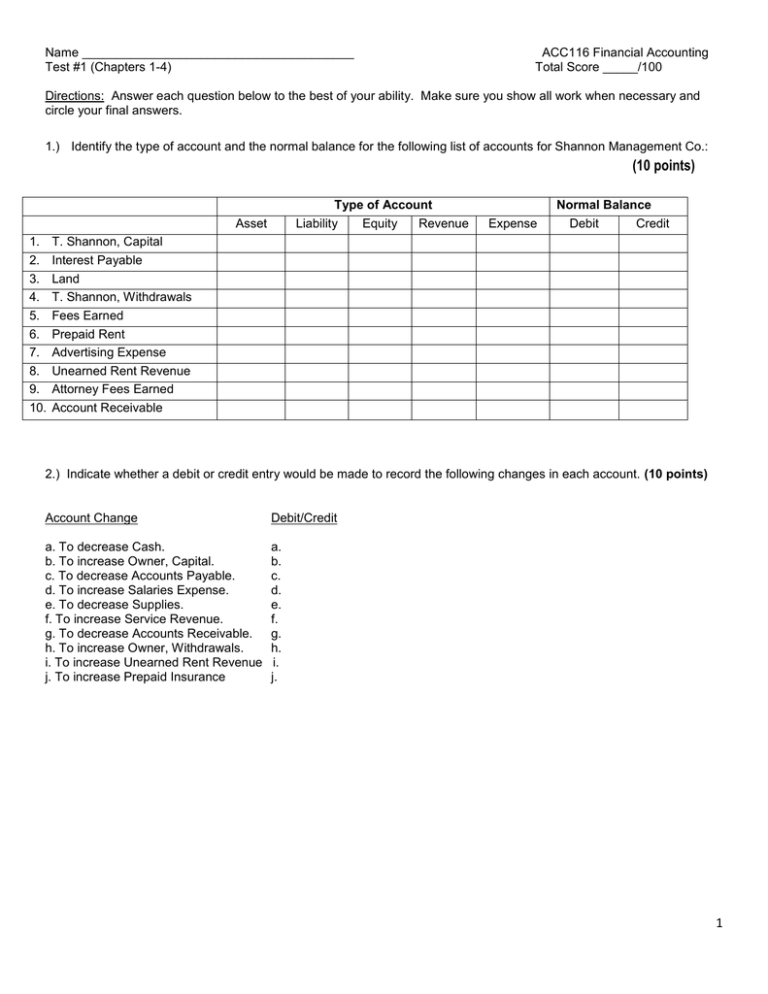

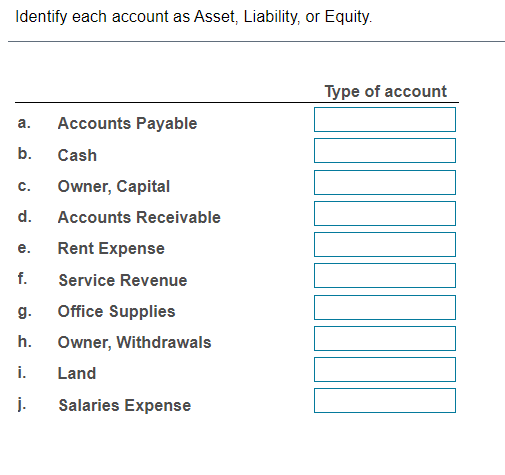

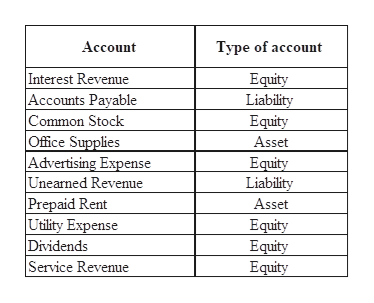

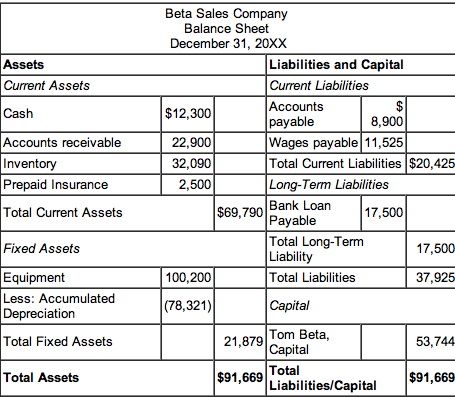

Account Types | Financial Accounting Assets: Assets are something you own or have and they are resources you expect to gain a benefit from in the future. Service Revenue (revenue from completing a service, could be specific like plumbing service revenue, accounting service revenue, photography service revenue, etc.) Is service revenue an asset? | Indeed.com For accounting purposes, service revenue isn't an asset. An asset refers to an item that provides economic value within a year or less. Revenue is income that comes from a business's primary service and most companies use it to reinvest in the company, which means it's not an asset.

Is service revenue an asset or liability? - Answers Best Answer. Copy. Services revenue is revenue same as product revenue and it is not an asset or liability of the business. Add your answer: Earn +20 pts. Q: Is service revenue an asset or liability?

Is service revenue an asset

Revenue - Definition, Formula, Example, Role in Financial Statements Revenue is the value of all sales of goods and services recognized by a company in a period. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has... Is Service Revenue an Asset? - FundsNet Service revenue is not an asset, though it does contribute to the accumulation of assets. So yeah, service revenue is not an asset. Rather, it is a revenue account. The confusion is understandable though as when you earn service revenue, your total assets also increase. The Road to Transportation-As-A-Service | by Paul Asel | Medium The traditional "Transportation as an Asset" model — in which a person buys, owns, and drives her own car — is shifting to "Transportation as a As the chart below illustrates, PriceWaterhouseCoopers projects nearly 20% of industry revenues and 36% of profit will shift from auto sales to services by...

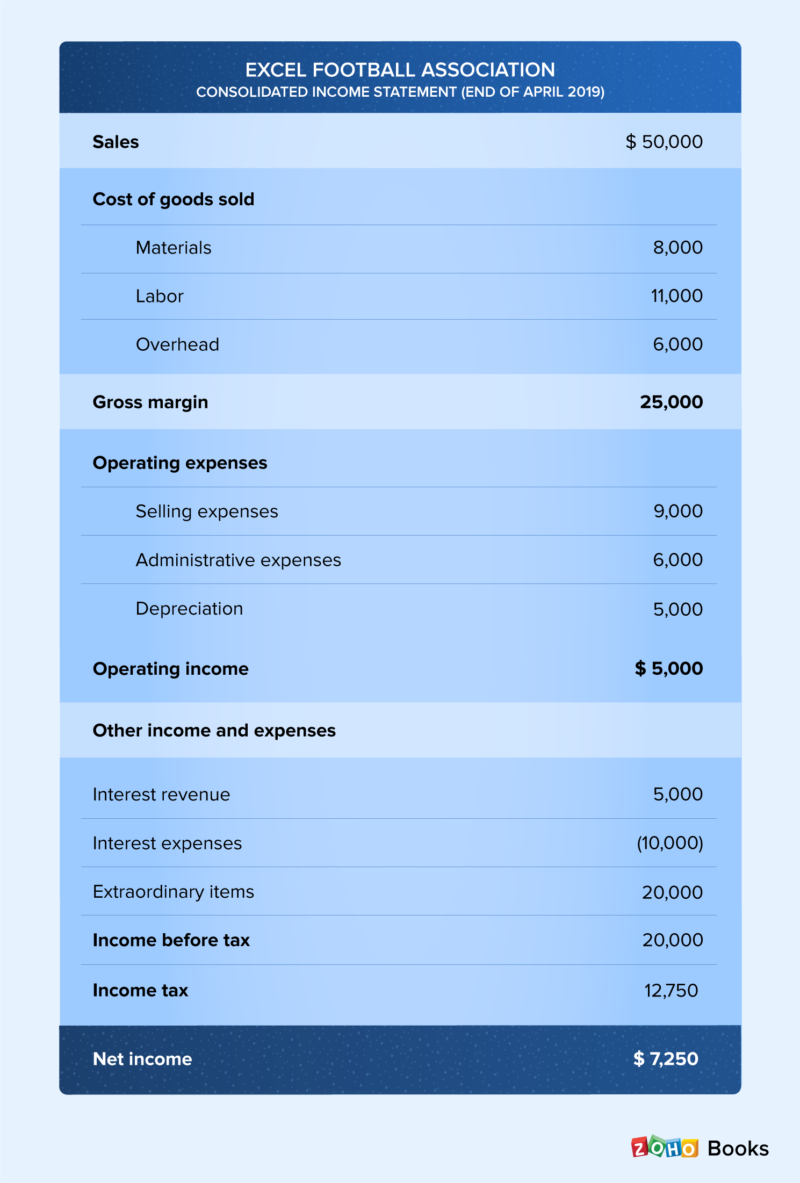

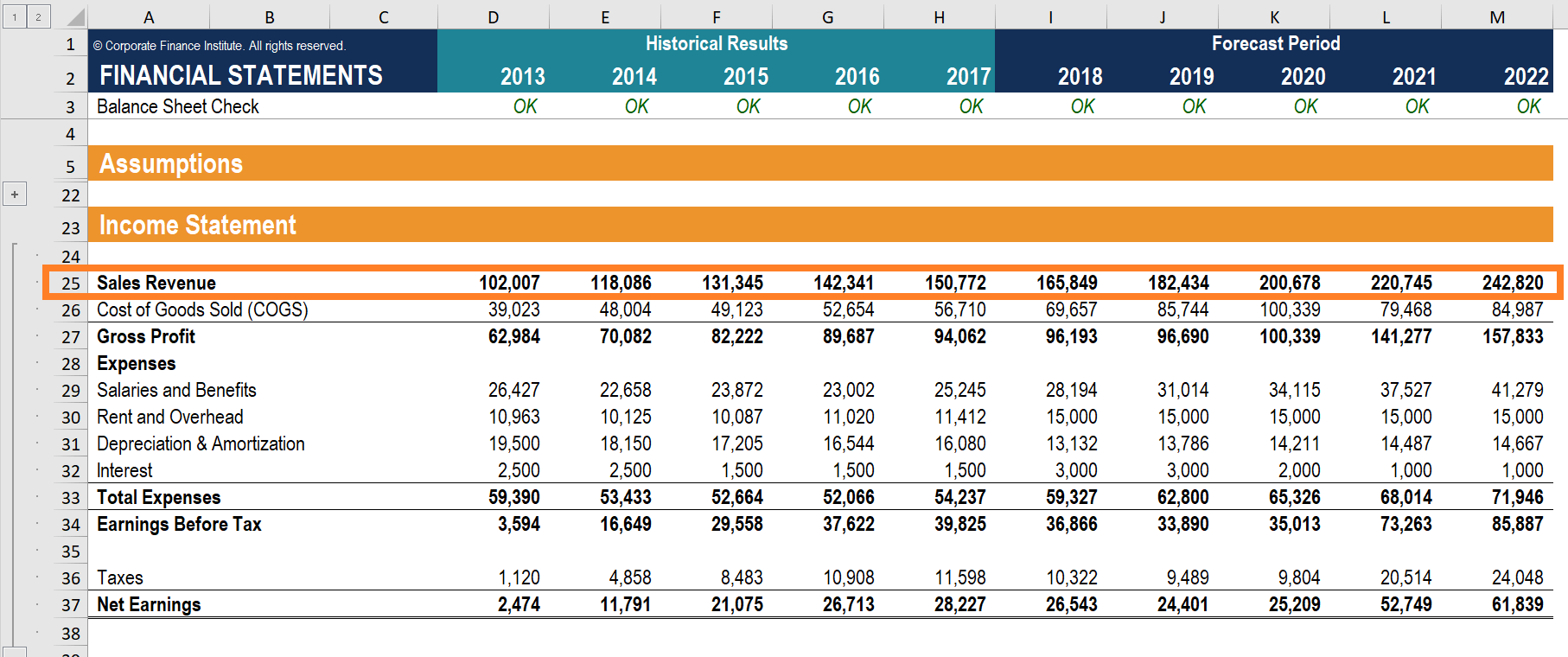

Is service revenue an asset. Service revenue 101: Asset or liability? + how to calculate it 2. Is service revenue an asset or liability? 3. 3 steps to accurately classify and record service revenue 4. Simple and accurate The major reason that service revenue isn't a current asset is that it's not directly related to any one company. It has more potential than other types of assets, but there... Revenue - Meaning, Formula, Examples, Sources and Types Revenue refers to a firm's total earnings from primary business operations such as sale of goods or services rendered. It is shown as a top-line item in the income statement and is often referred to as gross Revenue formula = Average Unit Price × Number of Units Sold/ Number of Customers Served. Assets vs. Liabilities & Revenue vs. Expenses - Chron.com Assets and liabilities are the fundamental elements of your company's financial position. Revenue and expenses represent the flow of money through your Liabilities are your company's obligations - either money that must be paid or services that must be performed. A successful company has more... Publication 551 (12/2018), Basis of Assets | Internal Revenue Service Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Intangible assets include goodwill, patents, copyrights, trademarks, trade names, and franchises. The basis of an intangible asset is usually the cost to buy or create it.

› publications › p946Publication 946 (2020), How To Depreciate Property | Internal ... Section 179 deduction dollar limits. For tax years beginning in 2021, the maximum section 179 expense deduction is $1,050,000. This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds $2,620,000.Also, the maximum section 179 expense deduction for sport utility vehicles placed in service in tax years beginning in 2021 is $26,200. Accounting 1040 3-5 Flashcards | Quizlet Service revenue. Which of the following accounts normally has a credit balance? Asset accounts are increased by debits, whereas, liabilities and owners' equity Whenever transactions affect the revenue or expenses of more than one accounting period. Adjusting entries are needed: A contra-asset account. Revenue is the income generated from normal business operations. Operating income is revenue (from the sale of goods or services) less operating expenses. Non-operating income is infrequent or nonrecurring income For example, proceeds from the sale of an asset, a windfall from investments, or money awarded through litigation are non-operating revenue. Why is Rent Expense a debit and Service Revenues a credit? Service revenues (and any other revenues) will increase a company's owner's equity (or stockholders' equity). If the company earns and receives $300 for providing a service, the company's assets and owner's equity will increase. The asset Cash will be increased with a debit of $300.

Elements of Accounting - Assets, Liabilities, and Capital A. Current assets - Assets are considered current if they are held for the purpose of being traded, expected to be realized or consumed within twelve Revenues refer to the amounts earned from the company's ordinary course of business such as professional fees or service revenue for service... Is Service Revenue an Asset? Service revenue itself is not an asset. This can be confusing because service revenue technically contributes to your "asset account" in your ledger when using the double-entry accounting method. Nonetheless, for financial accounting purposes, service revenue is not considered an asset. › businesses › small-businesses-selfSale of a Business | Internal Revenue Service May 28, 2021 · For more information, see Internal Revenue Code section 332 and its regulations. Allocation of consideration paid for a business. The sale of a trade or business for a lump sum is considered a sale of each individual asset rather than of a single asset. › about › historyInternal Revenue Service - United States Secretary of the ... Oct 03, 2010 · The Internal Revenue Service (IRS) is responsible for the determination, assessment, and collection of internal revenue in the United States. This revenue consists of personal and corporate income taxes, excise, estate, and gift taxes, as well as employment taxes for the nation s Social Security system.

› terms › aAsset Definition - Investopedia Jan 27, 2022 · Asset: An asset is a resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit. Assets are reported on a ...

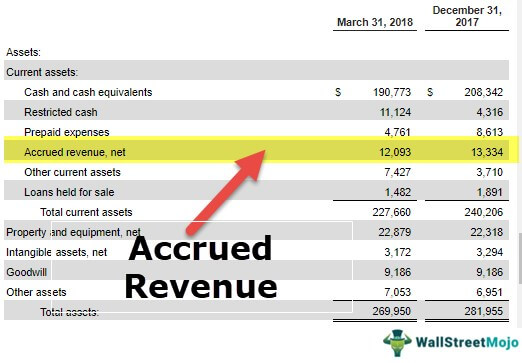

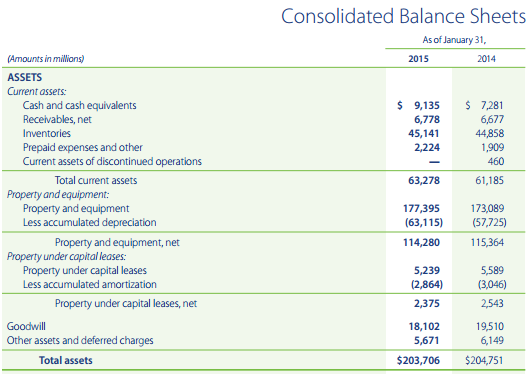

Is Service Revenue a Current Asset? | Finance Strategists While service revenue is not a current asset, accounts receivable and cash generated by the service revenue is recorded as a current asset on the balance sheet. Revenue is used to invest in other assets, pay off liabilities, and pay dividends to shareholders. Therefore, revenue itself is not an asset.

What Is an Asset? Types & Examples in Business Accounting | NetSuite "Asset" is one of those words that has both a casual meaning and a specific definition. As part of everyday speech, asset is used favorably: "He's a The International Financial Reporting Standards (IFRS) defines an asset as "a resource controlled by the enterprise as a result of past events and...

IFRS In practice 2020-2021 Revenue is recognised by a vendor when control over the goods or services is transferred to the customer. In contrast, IAS 18 based revenue recognition Two or more promises (such as a promise to supply materials (such as bricks and mortar) for the construction of an asset (such as a wall) and a...

Is Service Revenue an Asset? Breaking down the Income Statement Is Service Revenue an Asset? Breaking down the Income Statement; Service revenue is the income a company generates from providing a service. The amount is displayed at the top of an income statement and is added to the revenue from product earnings to show a company’s total revenue during a specific time period.

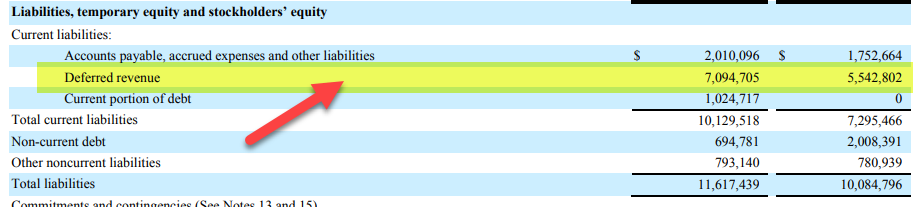

Contract Assets and Contract Liabilities (IFRS 15) - IFRScommunity.com the asset corresponding to recognised revenue is classified as a receivable and not a contract asset (IFRS 15.105, BC323-326). A contract liability is an entity's obligation to transfer goods or services and is recognised when a payment from a customer is due (or already received) before a related...

PDF provisions | Revenue 12. Revenue comprises gross inflows of economic benefits or service potential received and receivable by the reporting entity, which represents an 18. As an administrative convenience, a transferred asset, or other future economic benefits or service potential, may be effectively returned by deducting...

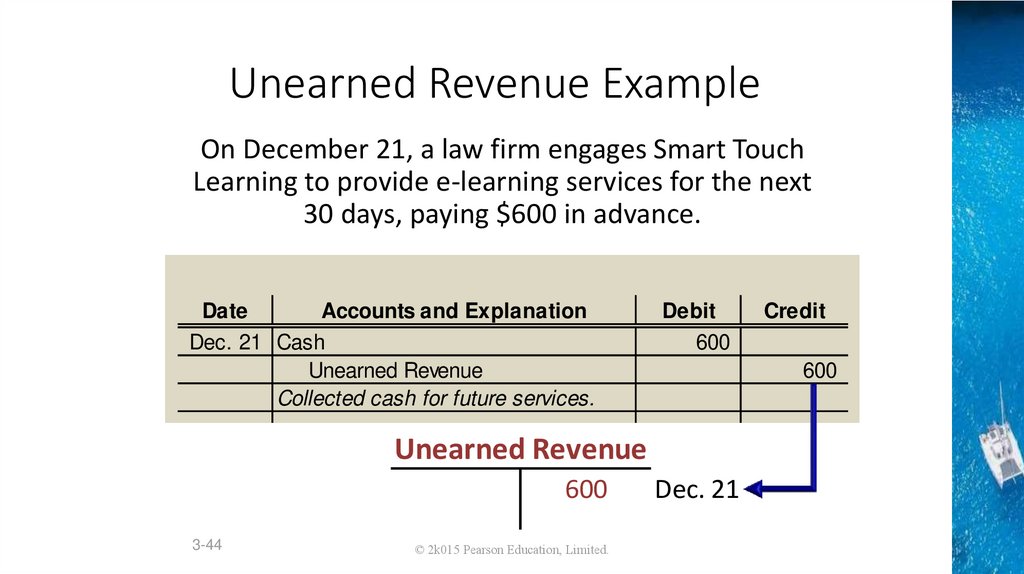

IS UNEARNED REVENUE AN ASSET OR LIABILITY? - Wikiaccounting Unearned revenue, also calls deferred revenues, is a liability account because it represents the revenue that is not yet earned. After all, the services or products are not yet delivered to the customer. When the cash is received, a liability account is created with corresponding equal entry in cash...

Is Service Revenue an Asset? | Deskera Blog So, service revenue is considered a revenue (or income) account and not an asset. In this guide, we will go through the details of what service revenue and assets represent in accounting, and why service revenue can't be an asset. Read on to learn more about

› industries › oil-gasOil, Gas, and Energy | Industry Software | SAP Production and revenue accounting with upstream hydrocarbon accounting and management Visual user interface with interactive functionality for supply chain management Asset monitoring, based on granular data from sensors and maintenance history

What is an Asset? | Cimpl | Can a service be an asset? "Assets = (ITIL Service Strategy) Any resource or capability. The assets of a service provider include anything that could contribute to the delivery of a If you're a service provider, then the service is not an asset. You would expense costs related to providing the service and record revenues from the...

OneClass: is service revenue an asset revenues less expenses (ordered smallest to largest amounts) with miscellaneous expense listed last. Choose the correct answer for the below c. revenues, expenses, gains, and distributions to owners. d. assets, liabilities, and investments by owners.

Is service revenue an asset? - Quora Service revenue appears at the top of an income statement, and is separated but added to the product sales for a revenue total. Yes, rent revenue is always an asset as it gives additional income apart from the regular income which you get. But make sure you are using it wisely or else it can turn out to...

How to Increase Revenue by Implementing Asset... - Asset Infinity Revenue is also referred to as sales or turnover. Some of the companies receive their revenue from the interest, royalties, or other fees. Sales of the company allow to hire more people, buy more equipment, or manufacture products or deliver services. In a perspective, without sales, there will not...

Revenue - Wikipedia In accounting, revenue is the total amount of income generated by the sale of goods and services related to the primary operations of the business. Commercial revenue may also be referred to as sales or as turnover. Some companies receive revenue from interest, royalties, or other fees.

Service Revenue Asset Or Liability Economic Is Service Revenue an Asset? Breaking down the Income. Economy. Details: Service revenue is not an asset, but a revenue or income account. The five types of account classifications are: assets, which are items that a business owns, liabilities, which are debts that a is repair revenue asset or...

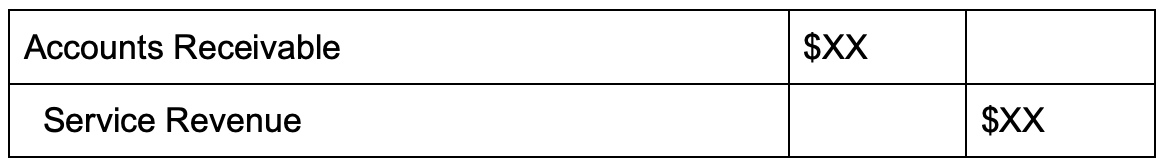

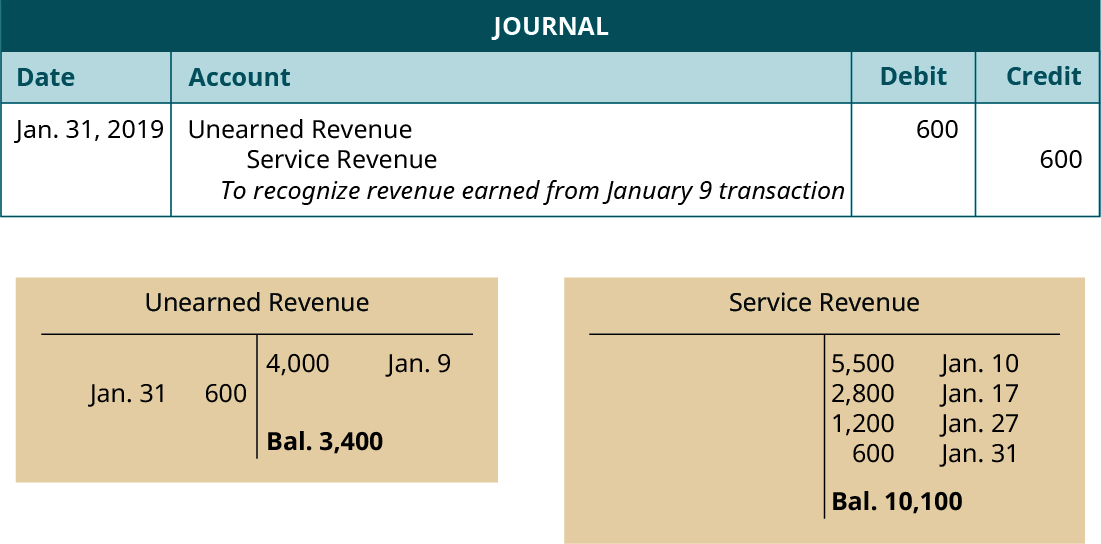

Is service revenue an asset? - Brainly.in At the time the service is performed the revenues are considered to have been earned and they are recorded in the revenueaccount Service Revenues with a credit. The other account involved, however, cannot be the asset Cash since cash was not received.

The Road to Transportation-As-A-Service | by Paul Asel | Medium The traditional "Transportation as an Asset" model — in which a person buys, owns, and drives her own car — is shifting to "Transportation as a As the chart below illustrates, PriceWaterhouseCoopers projects nearly 20% of industry revenues and 36% of profit will shift from auto sales to services by...

Is Service Revenue an Asset? - FundsNet Service revenue is not an asset, though it does contribute to the accumulation of assets. So yeah, service revenue is not an asset. Rather, it is a revenue account. The confusion is understandable though as when you earn service revenue, your total assets also increase.

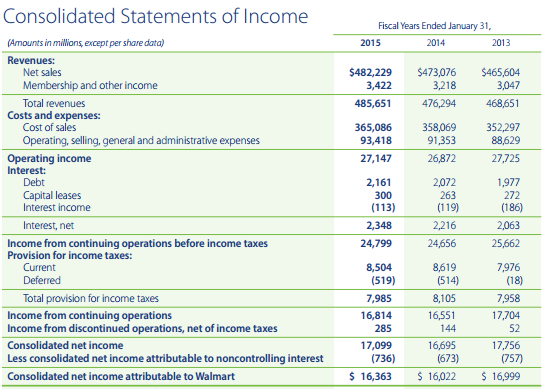

Revenue - Definition, Formula, Example, Role in Financial Statements Revenue is the value of all sales of goods and services recognized by a company in a period. According to the revenue recognition principle in accounting, revenue is recorded when the benefits and risks of ownership have transferred from seller to buyer or when the delivery of services has...

![Seitenbereiche: zum Inhalt [Alt+0] zum Hauptmenü [Alt+1] Über ...](https://www.list-group.at/storage/img/17/60/asset-01c755e7fc6f397e72fc.jpg)

/Clipboard02-5c6ecfab46e0fb0001b6815b.jpg)

0 Response to "39 is service revenue an asset"

Post a Comment