43 national pension scheme

National Pension Scheme - The Economic Times National Pension System is a government sponsored pension scheme.It is a contribution based scheme where the amount of pension to be received by you in the future depends on the amount of corpus accumulated at the time of scheme's maturity. National Pension Scheme (NPS) - Features, Advantages & Tax ... National Pension Scheme (NPS) NPS is an initiative undertaken by the Government of India, which seeks to provide retirement benefits to all citizens of India, even from the unorganized sectors.

National Pension System - Retirement Plan for All ... The National Pension System (NPS) was launched on 1st January, 2004 with the objective of providing retirement income to all the citizens. NPS aims to institute pension reforms and to inculcate the habit of saving for retirement amongst the citizens. Initially, NPS was introduced for the new government recruits (except armed forces).

National pension scheme

NPS Account - National Pension Scheme Features & Benefits ... National Pension System (NPS) is a retirement benefit Scheme introduced by the Government of India to facilitate a regular income post retirement to all the subscribers. PFRDA (Pension Fund Regulatory and Development Authority) is the governing body for NPS. Salient Features & Benefits taxguru.in › income-tax › income-tax-benefitsIncome Tax benefits under National Pension Scheme (NPS) Income Tax benefits under National Pension Scheme (NPS) NPS is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life. National Pension System National Pension System. Retired life ka sahara, NPS hamara. Home> Please enter a proper Aadhaar Number Mismatch in Aadhaar number entered Please enter the scheme percentage Please enter a valid percentage distribution in numerics. Decimal in only .5 are allowed Please enter a ...

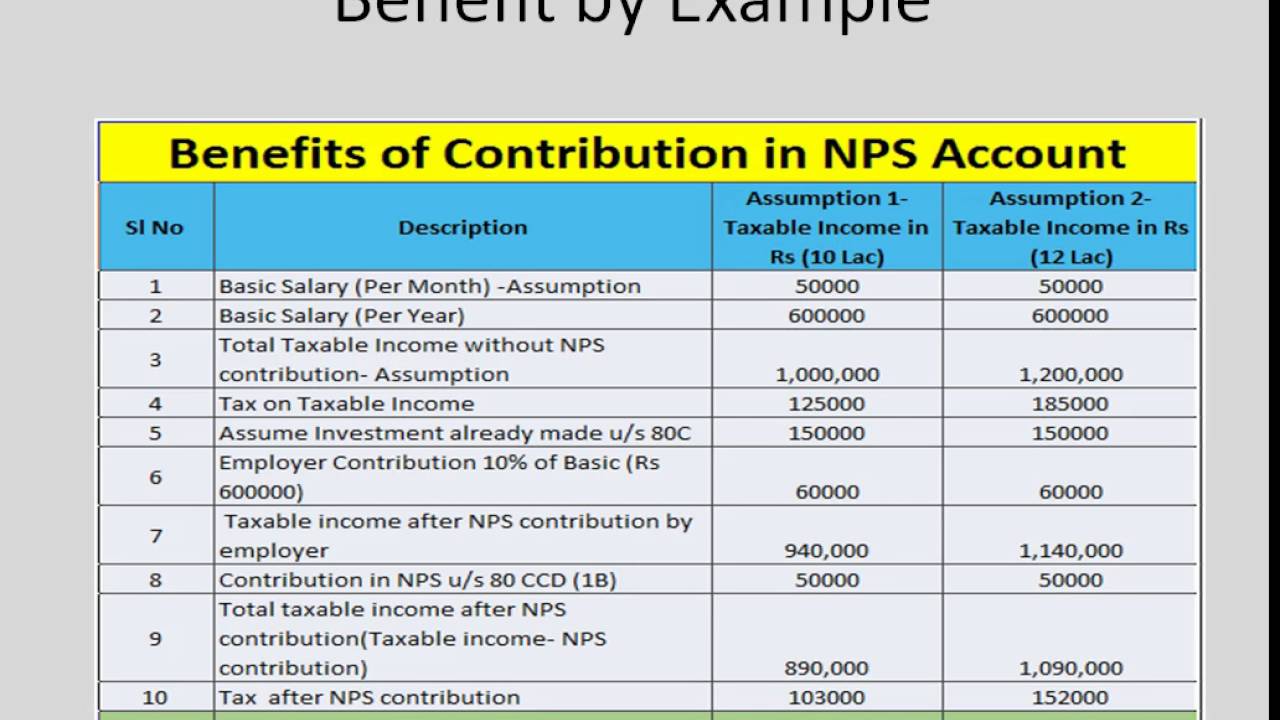

National pension scheme. National Pension Scheme Authority - Guaranteed Social Security The National Pension Scheme Authority (NAPSA) was established in February 2000 by the National Pension Scheme Act no. 40 of 1996 of the Laws of Zambia. Thisfollowed the closure of the Zambia National Provident Fund (ZNPF) after the responsible Act under which it was formed was repealed. How to Invest in National Pension Scheme - BankBazaar The National Pension Scheme allows online investment. It is handled by the Pension Fund Regulatory and Development Authority (PFRDA). Both employees and employers contribute towards this retirement benefit scheme. NPS scheme is particularly designed to encourage systematic savings among employees of both central and state and among common ... NPS: National Pension System, Benefits of NPS, NPS Tax ... National Pension Scheme (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life. National Pension Scheme (NPS) - What is NPS, Contribution ... The National Pension Scheme is one of the most popular annuity products in the country. Investing in the NPS scheme not only provides an advantage to the investors over other fixed-income schemes but also offers the perk of tax exemption Under Section 80C and 80CCD of the Income Tax Act.

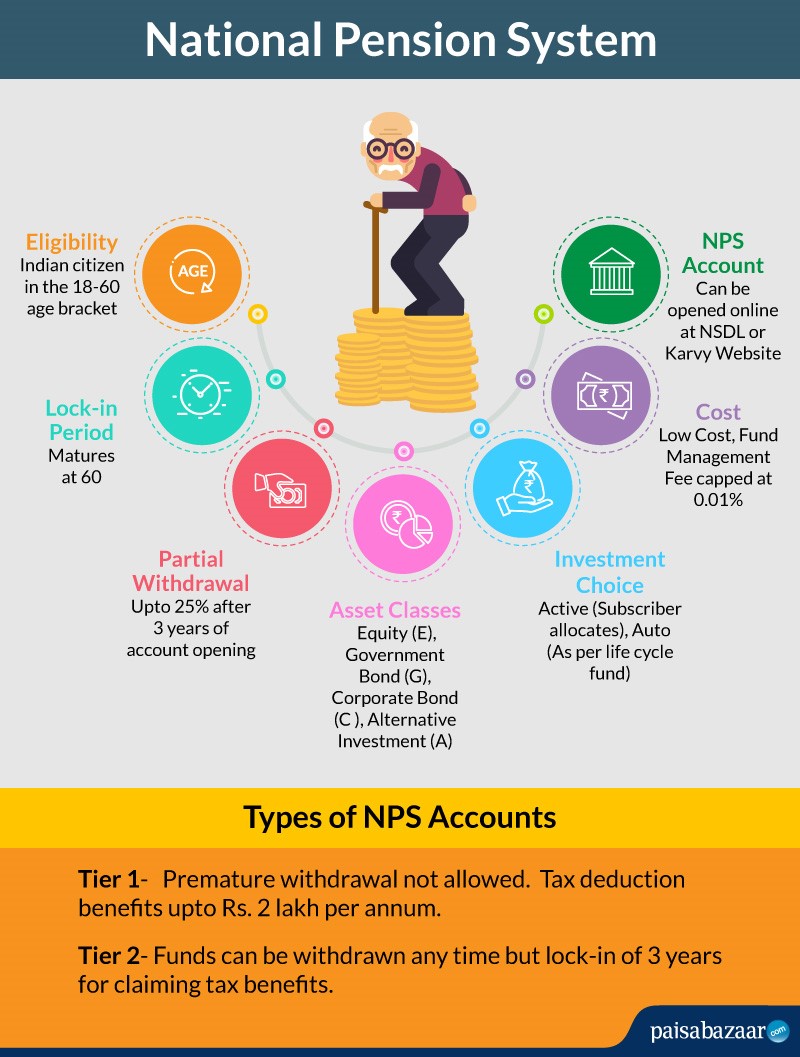

byjus.com › free-ias-prep › national-pension-schemeNational Pension Scheme (NPS) - Benefits, Features & More ... The National Pension System (NPS) is a pension scheme sponsored by the government that was started in 2004 for all government employees. The scheme was made open to all citizens in 2009. It is a voluntary and long-term retirement scheme. It is regulated by the Pension Fund Regulatory and Development Authority (PFRDA) and Central Pension Calculator - NPS Trust Pension Calculator. This pension calculator illustrates the tentative Pension and Lump Sum amount an NPS subscriber may expect on maturity or 60 years of age based on regular monthly contributions, percentage of corpus reinvested for purchasing annuity and assumed rates in respect of returns on investment and annuity selected for. National Pension Scheme (NPS): Eligibility, Joining ... National Pension Scheme (NPS): Eligibility, Joining Process and Types. National Pension Scheme or NPS scheme is an initiative of the government of India. It is a contribution-based pension scheme that allows a person to create a retirement corpus. Men and women can use it as a saving-investment or post-retirement tool. cleartax.in › s › nps-national-pension-schemeNPS, National Pension Scheme - ️What is NPS ️Account Opening ... The National Pension Scheme is a social security initiative by the Central Government. This pension programme is open to employees from the public, private and even the unorganised sectors except those from the armed forces.

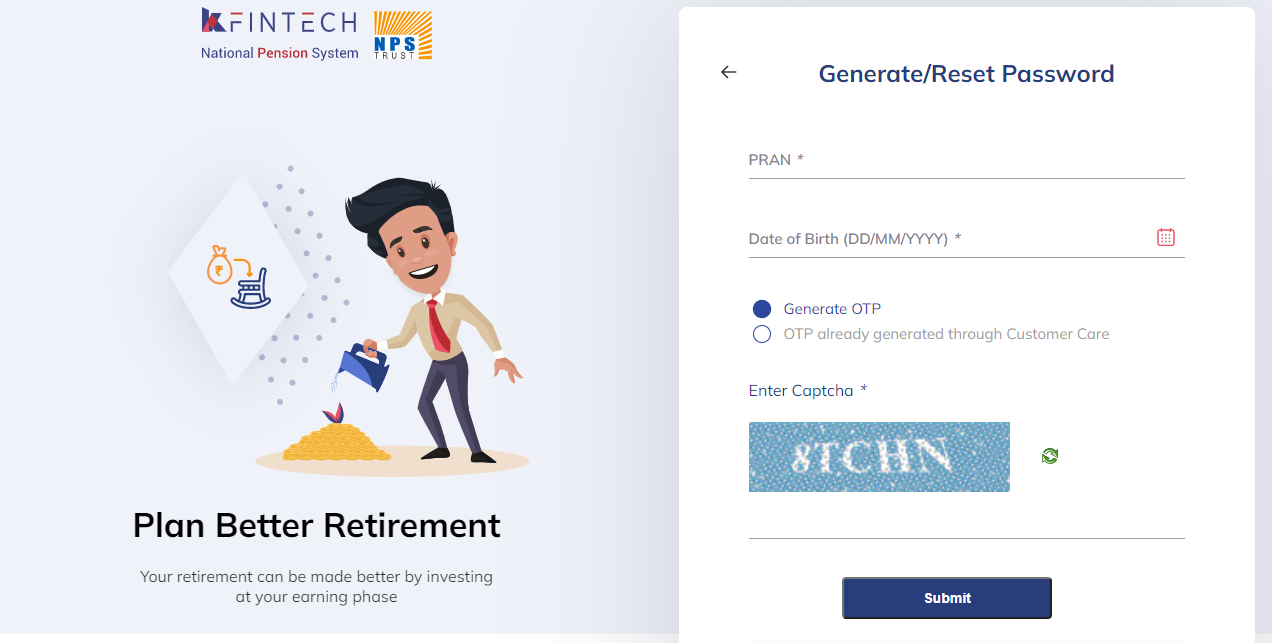

› about › other-businessNational Pension Scheme - UTI Asset Management National Pension System (NPS) is a ‘Government of India’ initiative with an objective of Development of a sustainable and efficient voluntary defined contribution Pension System in India. It is regulated by Pension Fund Regulatory and Development Authority (PFRDA). KFintech National Pension System account login allows NPS subscribers to access account online to check pension fund balance and other NPS details. NPS Eligibility - National Pension System Eligibility The account can be opened by all Indian Citizens between 18 to 60 Years. Steps for online account opening: Subscriber can enrol for NPS by clicking on 'Apply Now' option under NPS (National Pension System) Subscriber will get online form, which needs to be filled with mandatory fields. National Pensions Scheme - Mauritius (a) The National Pensions Act also provides for the payment of contributions on a voluntary basis by self-employed and non-employed persons. Contributions may be paid in multiples of five rupees, the minimum amount of contributions being Rs 170 a month and the maximum amount Rs 990 a month.

Social Assistance Programme (NSAP)|Ministry Of Rural ... Indira Gandhi National Disability Pension Scheme (IGNDPS): BPL persons aged 18-59 years with severe and multiple disabilities are entitled to a monthly pension of Rs. 300/-. National Family Benefit Scheme (NFBS): Under the scheme a BPL household is entitled to lump sum amount of money on the death of primary breadwinner aged between 18 and 64 ...

NPS Calculator - Calculate National Pension Scheme Online National Pension Scheme Calculator is an online tool, which allows the individual to calculate the estimated lump-sum and pension amount that they will receive under the NPS scheme. Best Pension Options Get Tax Free Pension For Life Flexibility to withdraw fund value any time Guaranteed Tax Savings Under Sec 80 C & 10 (10D)

National Pension Scheme - INSIGHTSIAS National Pension System (NPS) is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life.

eNPS - National Pension System eNPS - National Pension System Guidelines for Online Registration NPS Trust welcomes you to 'eNPS' ,which will facilitate:- Opening of Individual Pension Account under NPS (only Tier I / Tier I & Tier II) by All Indian Citizens (including NRIs) between 18 - 70 years

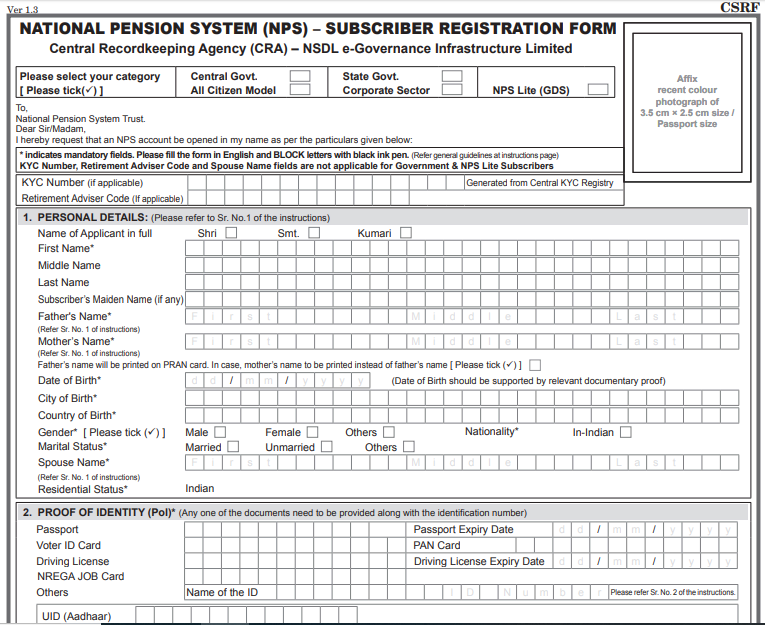

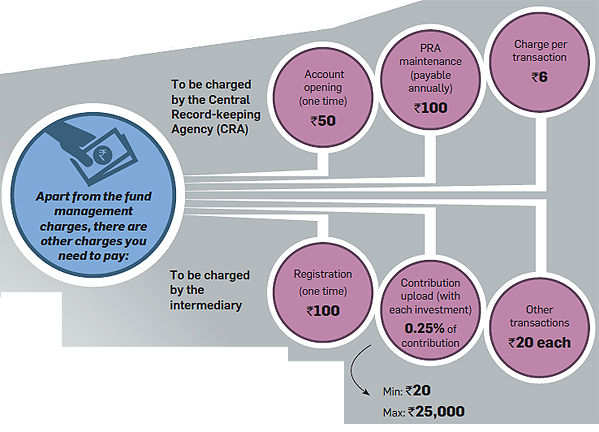

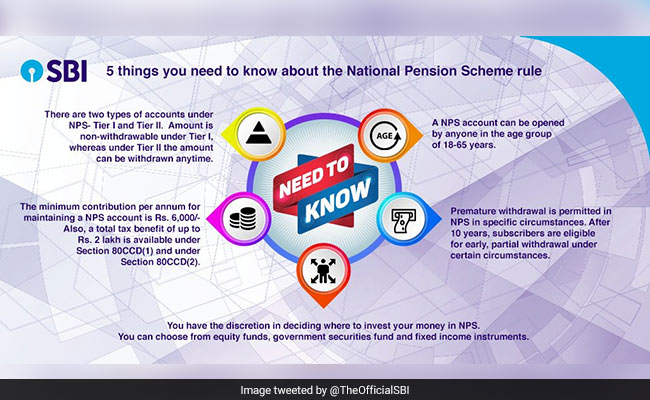

National Pension System | Department of Financial Services ... The National Pension System (NPS) is being administered and regulated by Pension Fund Regulatory and Development Authority (PFRDA) set up under PFRDA Act, 2013. NPS is a market linked, defined contribution product. Under NPS, a unique Permanent Retirement Account Number (PRAN) is generated and maintained by the Central Recordkeeping Agency (CRA ...

Benefits of the National Pension Scheme (NPS) National Pension Scheme or NPS, a government-run investment scheme, gives the subscriber the choice to set the favored portion to different asset classes. The subscriber can either apply for an NPS account by visiting a Point of Presence (PoP) or do it online through the e-NPS site. It was initially launched for government employees in 2004 and extended out to the general public in 2009.

PDF National Pension System (NPS) National Pension System (NPS) NPS, regulated by PFRDA, is an important milestone in the development of a sustainable and efficient voluntary defined contribution pension system in India. It has the following broad objectives: y To provide old age income y Reasonable market based returns over the long term

NPS: National Pension Schemes Eligibility, Types, Calculator The National Pension System (NPS), earlier known as the New Pension Scheme, is a pension system open to all citizens of India. The NPS invests the contributions of its subscribers into various market-linked instruments such as equities and debts and the final pension amount depends on the performance of these investments.

› Personal-Banking › accountNPS (National Pension Scheme) - Open NPS Account Online ... National Pension System - NPS. National Pension System (NPS) is a voluntary, defined contribution retirement savings system. This retirement scheme is designed to facilitate a regular income post retirement and is based on the unique Permanent Retirement Account Number (PRAN) which is allotted to every individual that applies for the same.

› offering › nps-national-pension-schemeNational Pension Scheme (eNPS): Online NPS Scheme & Tax ... National Pension Scheme (eNPS): It is a govt sponsored pension scheme with tax benefits under section 80C. Open your NPS account online with HDFC securities and financially secure your retirement life.

NPS - India Post National Pension System (NPS) is a voluntary retirement savings scheme laid out to allow the subscribers to make defined contribution towards planned savings thereby securing the future in the form of Pension. It is an attempt towards a sustainable solution to the problem of providing adequate retirement income to every citizen of India.

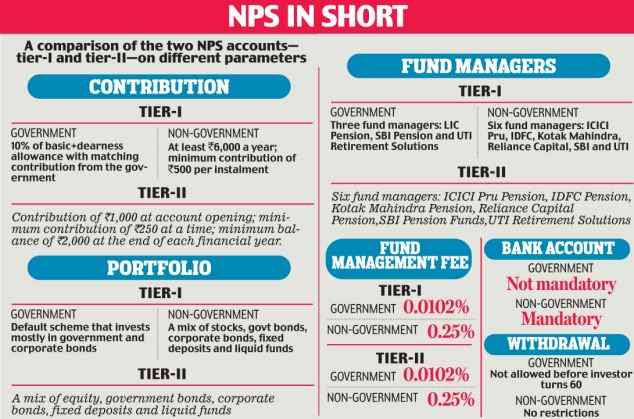

NPS - Personal Banking - SBI National Pension System (NPS) is a defined contribution pension system introduced by the Government of India as a part of Pension Sector reforms, with an objective to provide social security to all citizens of India. It is administered and regulated by PFRDA. Features of NPS scheme Tier I - Pension account (Mandatory A/C - Tax benefit available)

National Pension Scheme (NPS) Calculator: Online NPs ... National Pension Scheme (NPS) Calculator helps you to know the monthly pension and lump sum amount that you may get when you retire at the age of 60. NPS Calculator enables you to decide your monthly contribution towards NPS accordingly. Investment in NPS offers tax benefit under Section 80CCD and is an attractive retirement solution.

NPS: National Pension System | NPS Tax Benefits | Top ... National Pension System (NPS) is a defined contribution pension system. NPS schemes have two options. Tier 1 and Tier 2. Tier 1 has a longer lock in period (15 years for even partial withdrawal) as...

National Pension System National Pension System. Retired life ka sahara, NPS hamara. Home> Please enter a proper Aadhaar Number Mismatch in Aadhaar number entered Please enter the scheme percentage Please enter a valid percentage distribution in numerics. Decimal in only .5 are allowed Please enter a ...

taxguru.in › income-tax › income-tax-benefitsIncome Tax benefits under National Pension Scheme (NPS) Income Tax benefits under National Pension Scheme (NPS) NPS is a government-sponsored pension scheme. It was launched in January 2004 for government employees. However, in 2009, it was opened to all sections. The scheme allows subscribers to contribute regularly in a pension account during their working life.

NPS Account - National Pension Scheme Features & Benefits ... National Pension System (NPS) is a retirement benefit Scheme introduced by the Government of India to facilitate a regular income post retirement to all the subscribers. PFRDA (Pension Fund Regulatory and Development Authority) is the governing body for NPS. Salient Features & Benefits

.png)

0 Response to "43 national pension scheme"

Post a Comment