42 why do companies buy back shares

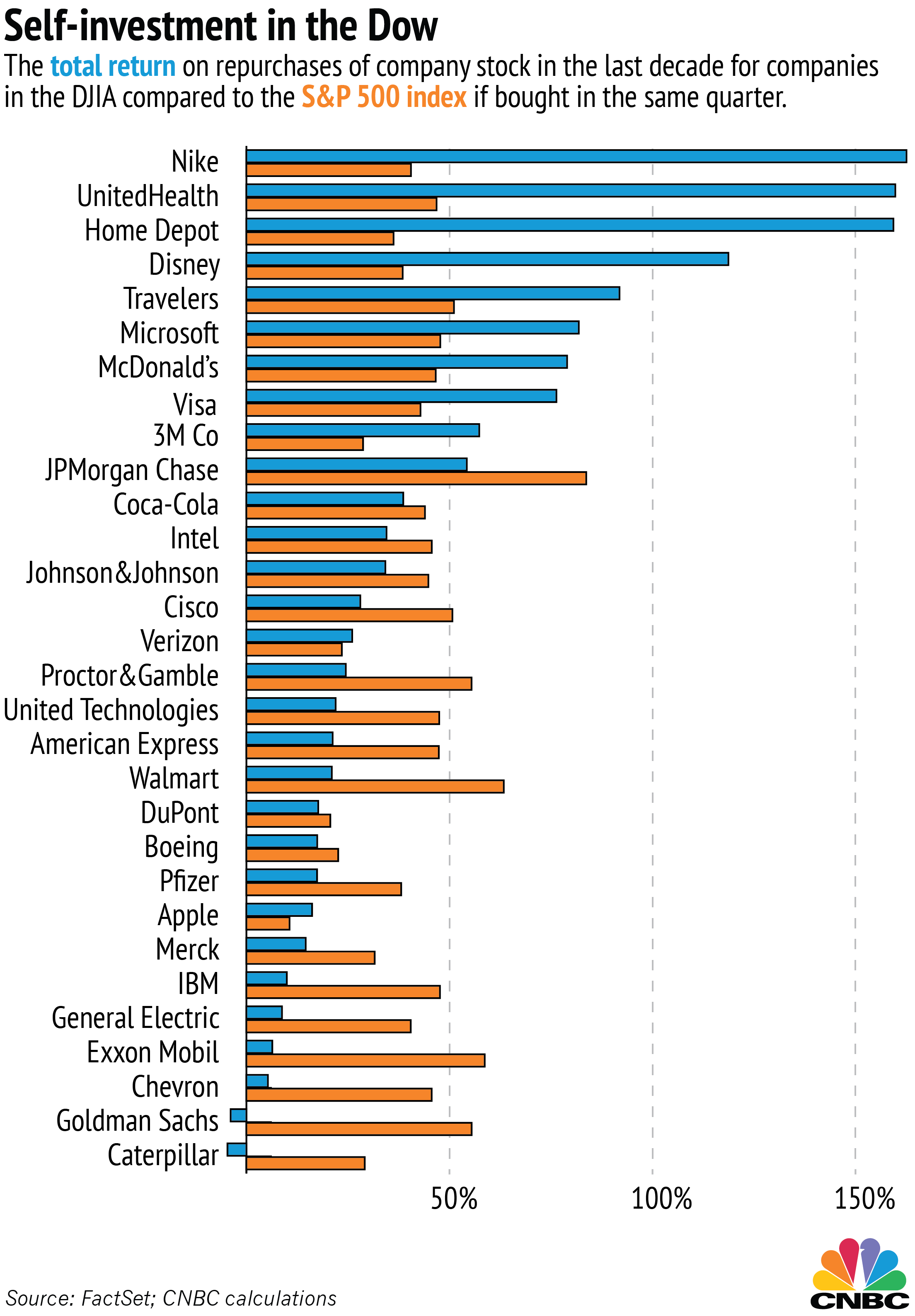

5 of the Best Stocks to Buy for March | Investing | US News Domino's Pizza shares have pulled back more than 25% to start 2022. The company has managed jaw-dropping growth over the past decade. Additionally, management's willingness to lever up the balance sheet and buy back stock has added a ton of shareholder value. Stock Buybacks: Why Do Companies Buy Back Shares? Why Would a Company Buy Back Its Own Shares? Key Takeaways. Companies do buybacks for various reasons, including company consolidation, equity value increase, and to look more financially attractive.

50 Ways Companies Are Giving Back During The Coronavirus... Buying A Car In A Red-Hot Market - Without Getting Burned. Here are 50 Examples of Companies Doing Good For The World During This Corona Virus Pandemic 3.Loom, a video recording and sharing service has made Loom Pro free for teachers and students at K-12 schools, universities, and...

Why do companies buy back shares

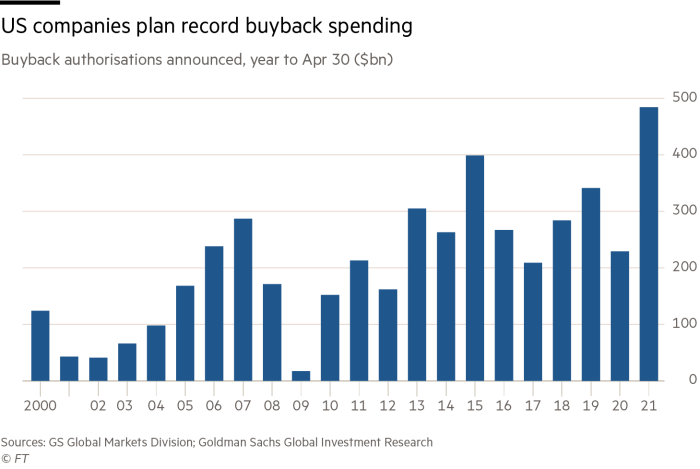

› investing › stock-marketBest Marijuana Stocks for 2022: Cannabis ... - The Motley Fool Feb 03, 2022 · If you buy broad-based index funds, you're covered no matter which sectors of the stock market do well. Conservative investors who prefer lower risk are likely better off avoiding investing in ... Amazon (AMZN) Will Split Stock 20-for-1, Plans Buyback... - Bloomberg Bloomberg the Company & Its ProductsThe Company & its Products Bloomberg Terminal Demo Amazon Jumps on Plan to Split Stock, Buy Back Up to $10 Billion. The split would be Amazon's first in That news combined with a $10 billion share-buyback authorization sent Amazon shares up as... Stock Buybacks: Why Do Companies Repurchase Their Own Shares... Companies are able to buy back shares at any time, but share repurchases are typically highest during periods of strong economic activity when companies have the cash available. In recent years, technology companies have been some of the largest buyers of their own shares.

Why do companies buy back shares. The Science Behind Branding and Consumer Choice Why do consumers prefer some brands to others? Explore the science behind effective branding and learn how to build lasting customer loyalty. Why do consumers choose the brands they do? You can bet their decisions aren't based on price alone. Stocks and shares This is why most people doing business form limited companies. The creditors simply do not get all their money back. Buying a share gives its holder part of the ownership of a company. Shares generally entitle their owners to vote at a company's Annual General Meeting (GB) or Annual Meeting... What Are Stock Buybacks and How Do They Work? Here is why companies buy back their own stock and why Pfizer, Nike and others should do so too. Stock buybacks are when companies repurchase shares of their own stock. Recent examples include bussiness english (softskill) Why do people buy brands? Because brands goods have high quality. I pay some loyalty to that company because I used their name of products for use in my own products. I don't enjoy my travelling when time to back to home. Put the following in order of importance to you when you travel?

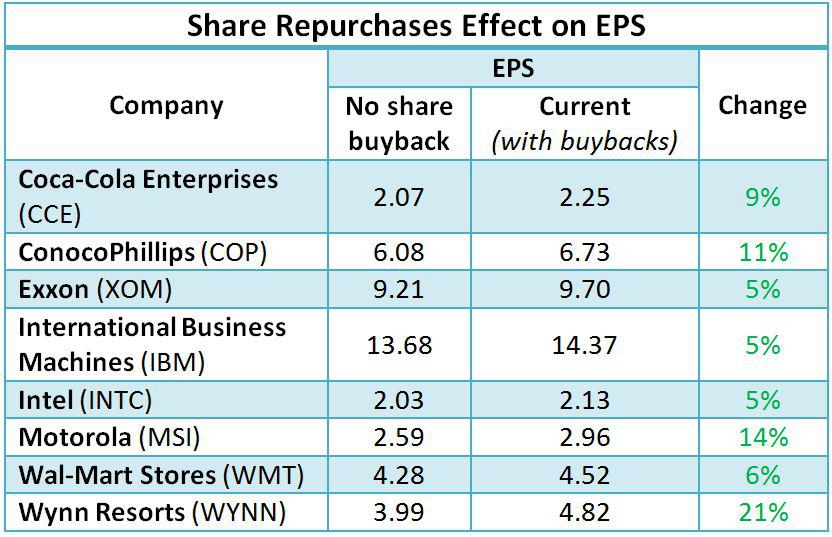

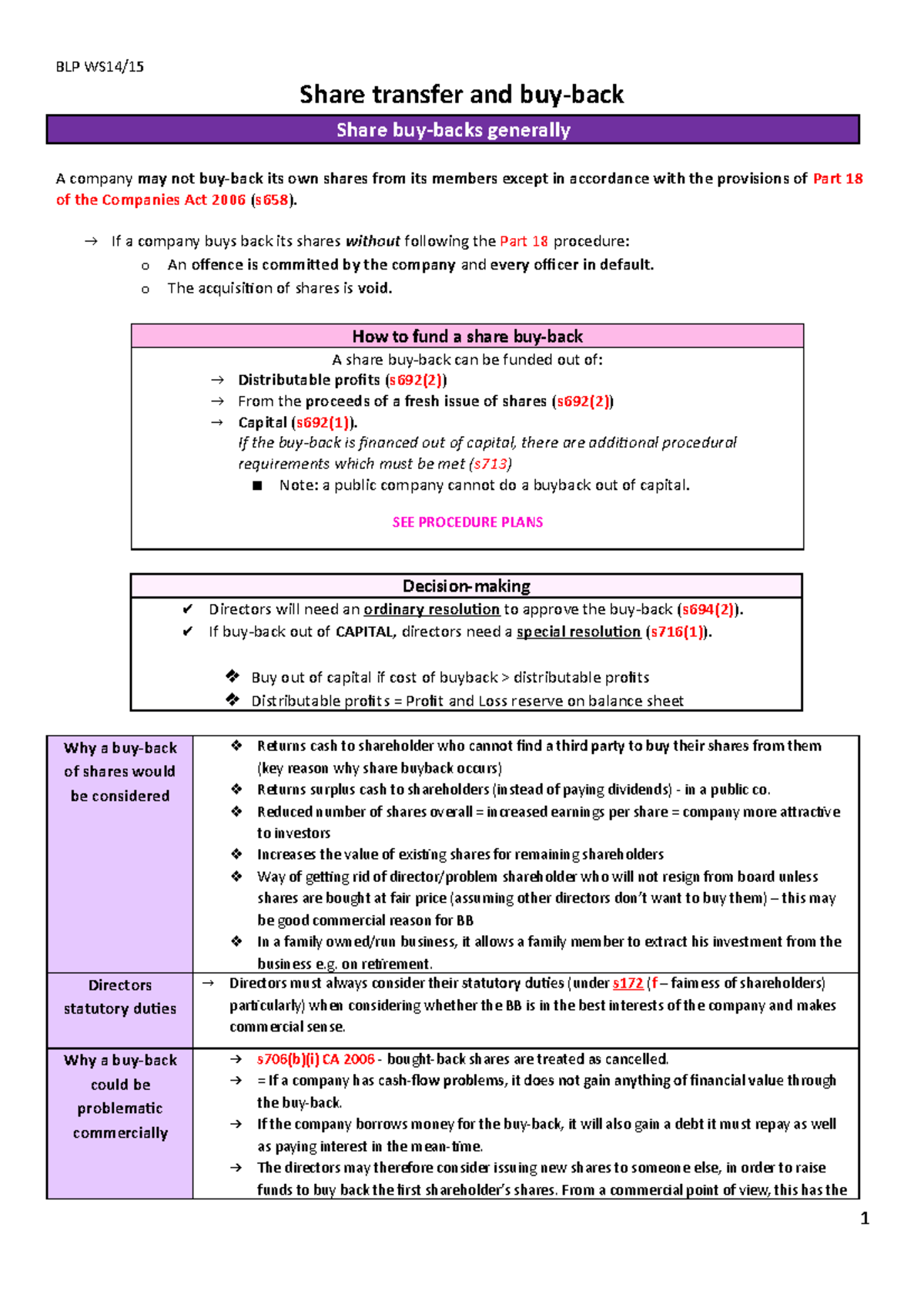

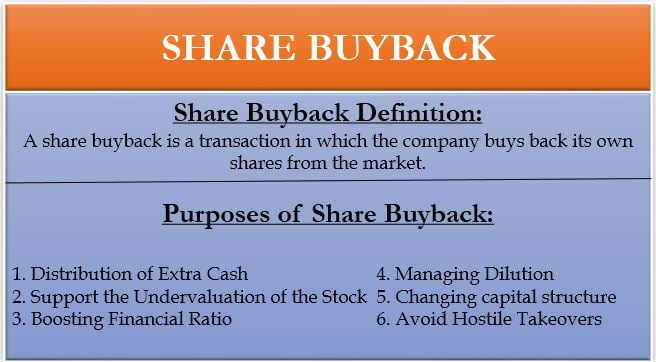

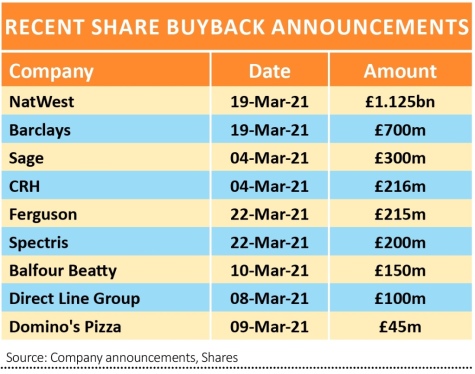

Treasury Stock (Definition) | How to Record Treasury Shares? Treasury Stocks are the set of shares which the issuing company has bought back from the existing shareholders of the company but not retired and thus they are not considered while calculating the earning per share or the dividends of the company. Why do companies buy back shares? - Relevance of share... A company can buy back its shares through two methods - from the existing shareholders on a proportionate basis through the tender offer; and In order to stabilise the share price by buying it at a premium to market price and reducing the number of shares in the market. It also improves the... Why Stock Buybacks From Amazon and Other Big Companies Could... M ajor companies like Amazon and Best Buy are buying back their own shares amid a rough period for the stock market. Companies in the S&P 500 and Russell 3000 have outlined stock buyback plans valued at $306 billion as of March 11, which is high for this point in the year, according Goldman... S&P 500 companies spent $270.1 billion buying back shares in... First, the amount spent by S&P 500 companies to buy back stock did indeed hit a record in Q4 2021. However, JPMAM's analysis found the change in share count actually had a modest net negative impact on EPS in 2021. From 2001 to 2020, on average the change in share count was...

Predicting the Stock Market Is Easier Than You Think | Medium So why do people still think day trading will make them rich? This can be explained by the fact that day trading is widely advertised as an effective strategy by the mainstream brokerage industry and financial media. Once it is shoved down retail traders' throats, they cave in to the constant propaganda and... How to Buy Stock: Step-by-Step Instructions for Beginners - NerdWallet To buy a stock, you'll want to evaluate the company, decide how much you want to invest and place a stock buy order. You can buy stocks online, through Buying stocks isn't as complicated as it seems, but you'll need to do some research — and learn the lingo — before you make your first investment. Stock Buybacks (Share Repurchases) Explained in One Minute: Why... A significant talking point with respect to many of the companies that are now seeking government assistance is this: aren't we in a bit of a moral hazard... Investors struggle to trade Russian assets as sanctions hit market... Why I should have listened to Garry Kasparov about Putin. Why I'll never buy an active investment fund again. Shares of Russian bank VTB were on Tuesday suspended on the London Stock Exchange Among the companies Nasdaq halted include Nexters, Yandex and Ozon Holdings.

When a stock price rises, does the company get more money? Economically speaking, a company should only buy back shares when those shares are undervalued. When a company buys back stock it is effectively the same as authorized but unissued stock and under most state laws the shares are just canceled increasing the number of...

Vivid | Why is everyone suddenly announcing stock buybacks? European companies have been announcing huge buyback programs as well. BMW, for example, announced it would buy back up to 10% of its own shares, despite six days later saying it might face some supply chain issues from Ukraine. Why are they doing this?

Stocks | Investor.gov | Why do people buy stocks? Why do companies issue stock? What kinds of stock are there? People buy value stocks in the hope that the market has overreacted and that the stock's price will rebound. Blue-chip stocks are shares in large, well-known companies with a solid history of growth.

Why do many companies issue 100 shares? Redeemable shares enable a company to buy back its issued shares after a fixed period of time. Often, they are created for employees and issued with the proviso that they are taken back if the employee leaves the company. Redeemable shares are often non-voting.

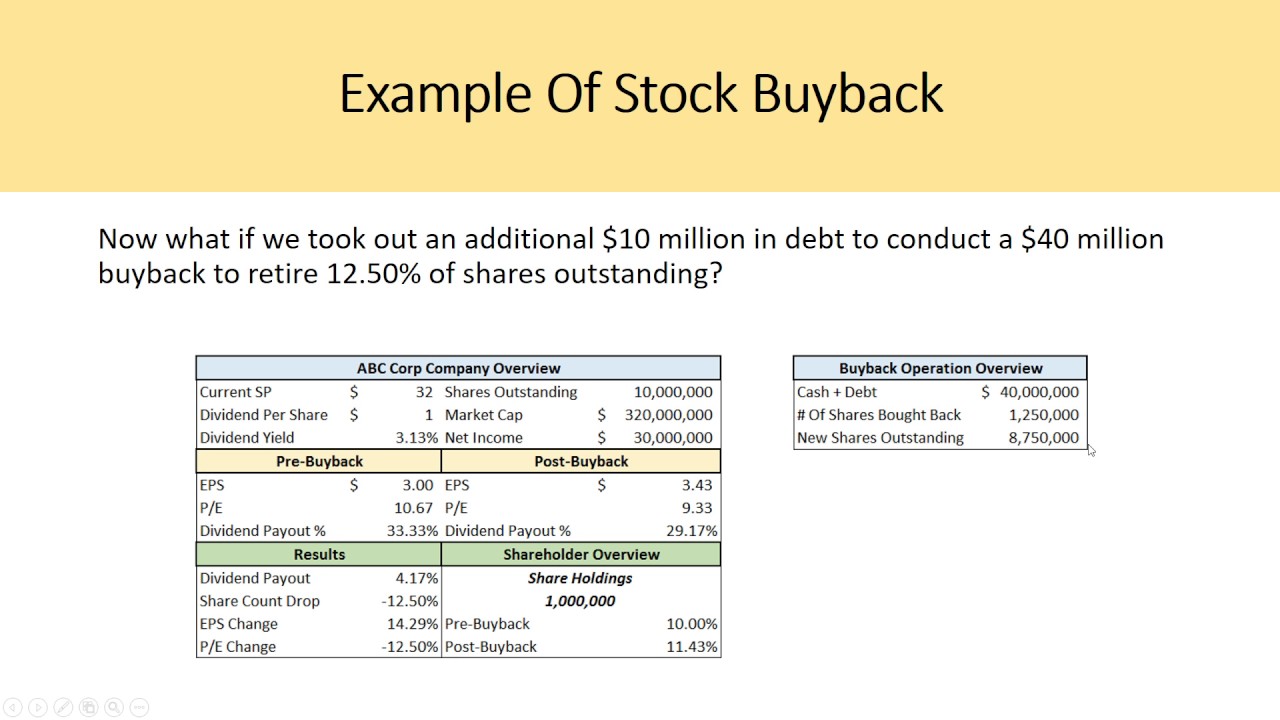

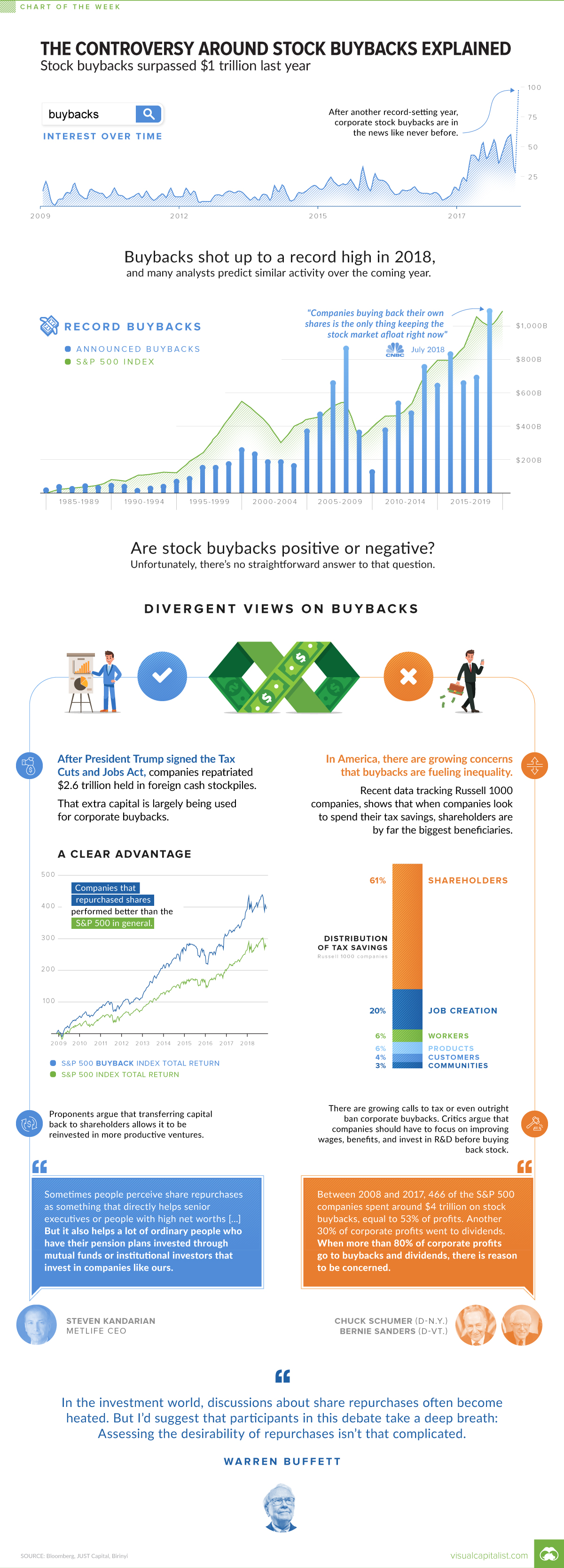

Stock Buybacks: Benefits of Share Repurchases A stock buyback occurs when a company buys back its shares from the marketplace. The effect of a buyback is to reduce the number of outstanding shares on the market, which increases the ownership stake of the stakeholders.

Buyback - How and why companies buy their own shares Buyback - How companies buy back shares. Buyback - buyback of shares by the issuer from their owners. Buyback is widespread all over the world and is popular with large issuers. We find out, why companies do it and how it can help to invest correctly, saving capital from possible losses.

What Is Market Share & How Do You Calculate It? Why is market share important? Calculating market share lets companies know how competitive they are in their industry. Additionally, the more market share a company has, typically the more innovative, appealing, and marketable they are.

What is the logical reason for the buy-back of shares by companies? Buy back is one of the ways of using excess cash available with companies. There are many reasons a company buy-backs its own shares. 4. To enable companies to make use of the buy-back shares for subsequent use in the process of mergers and acquisitions without enlarging their capital...

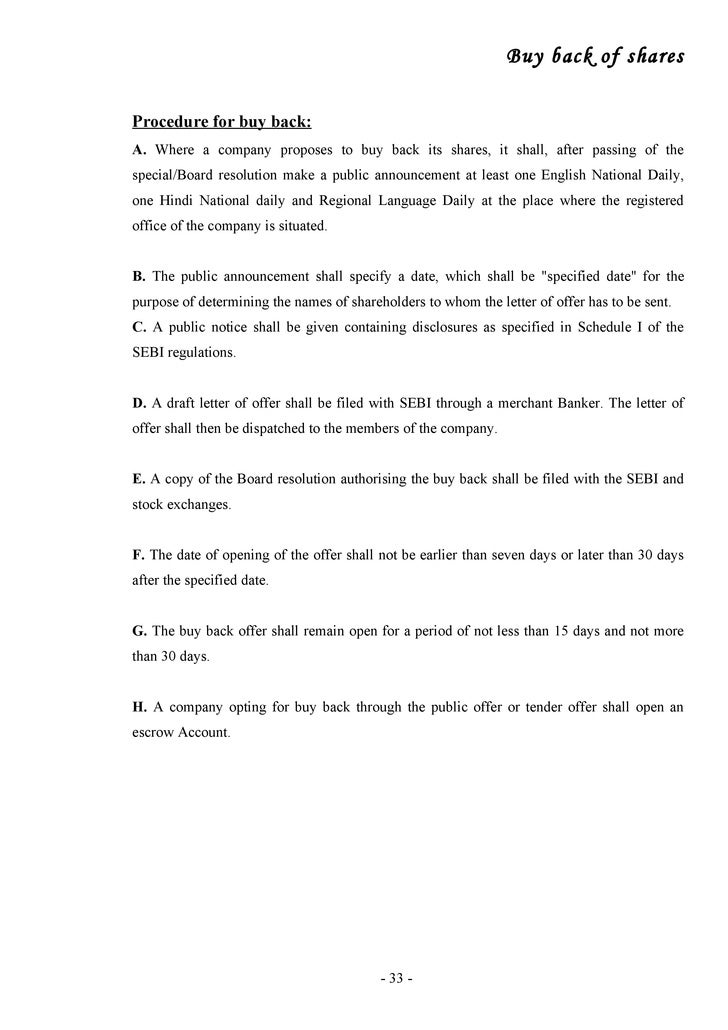

Why do companies buy back their own shares? On-market buybacks are when a company buys its own shares on an exchange in the ordinary course of trading. Off-market buybacks refer to Share buybacks carry tax implications, which are worth consideration, and are why companies announcing a buyback will generally suggest seeking...

Investment Banking interview questions: Merger Model (Basic) 3. Why would a company want to acquire another company? Several possible reasons: The buyer wants to gain market share by buying a competitor. 10. Why would a strategic acquirer typically be willing to pay more for a company than a private equity firm would? Because the strategic acquirer...

Share repurchase - Wikipedia Share repurchase (or share buyback or stock buyback) is the re-acquisition by a company of its own shares. It represents an alternate and more flexible way (relative to dividends) of returning money to shareholders.

What Makes a Stock Go Up? | The Motley Fool Learn why the stock market and individual stocks tend to fluctuate and how you can use that Billions of shares of stock are bought and sold each day, and it's this buying and selling that sets stock Confidence in the economy. The more confident investors are about a company's prospects or the...

› investing › 2022/02/15Why Airline Shares Are Flying High Today | The Motley Fool Feb 15, 2022 · The company announced it would exercise its option to buy an additional 30 Airbus planes in the years to come. Now what The worst may be over, but we still don't know how long the recovery will take.

Stock Buybacks: Why Do Companies Repurchase Their Own Shares... Companies are able to buy back shares at any time, but share repurchases are typically highest during periods of strong economic activity when companies have the cash available. In recent years, technology companies have been some of the largest buyers of their own shares.

Amazon (AMZN) Will Split Stock 20-for-1, Plans Buyback... - Bloomberg Bloomberg the Company & Its ProductsThe Company & its Products Bloomberg Terminal Demo Amazon Jumps on Plan to Split Stock, Buy Back Up to $10 Billion. The split would be Amazon's first in That news combined with a $10 billion share-buyback authorization sent Amazon shares up as...

› investing › stock-marketBest Marijuana Stocks for 2022: Cannabis ... - The Motley Fool Feb 03, 2022 · If you buy broad-based index funds, you're covered no matter which sectors of the stock market do well. Conservative investors who prefer lower risk are likely better off avoiding investing in ...

/SHAREBUYBACKFINALJPEGII-e9213e5fe3a9435b9d0cc4d33d33a591.jpg)

/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

0 Response to "42 why do companies buy back shares"

Post a Comment