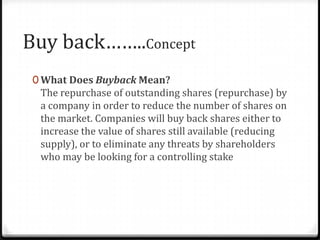

43 what does share buyback mean

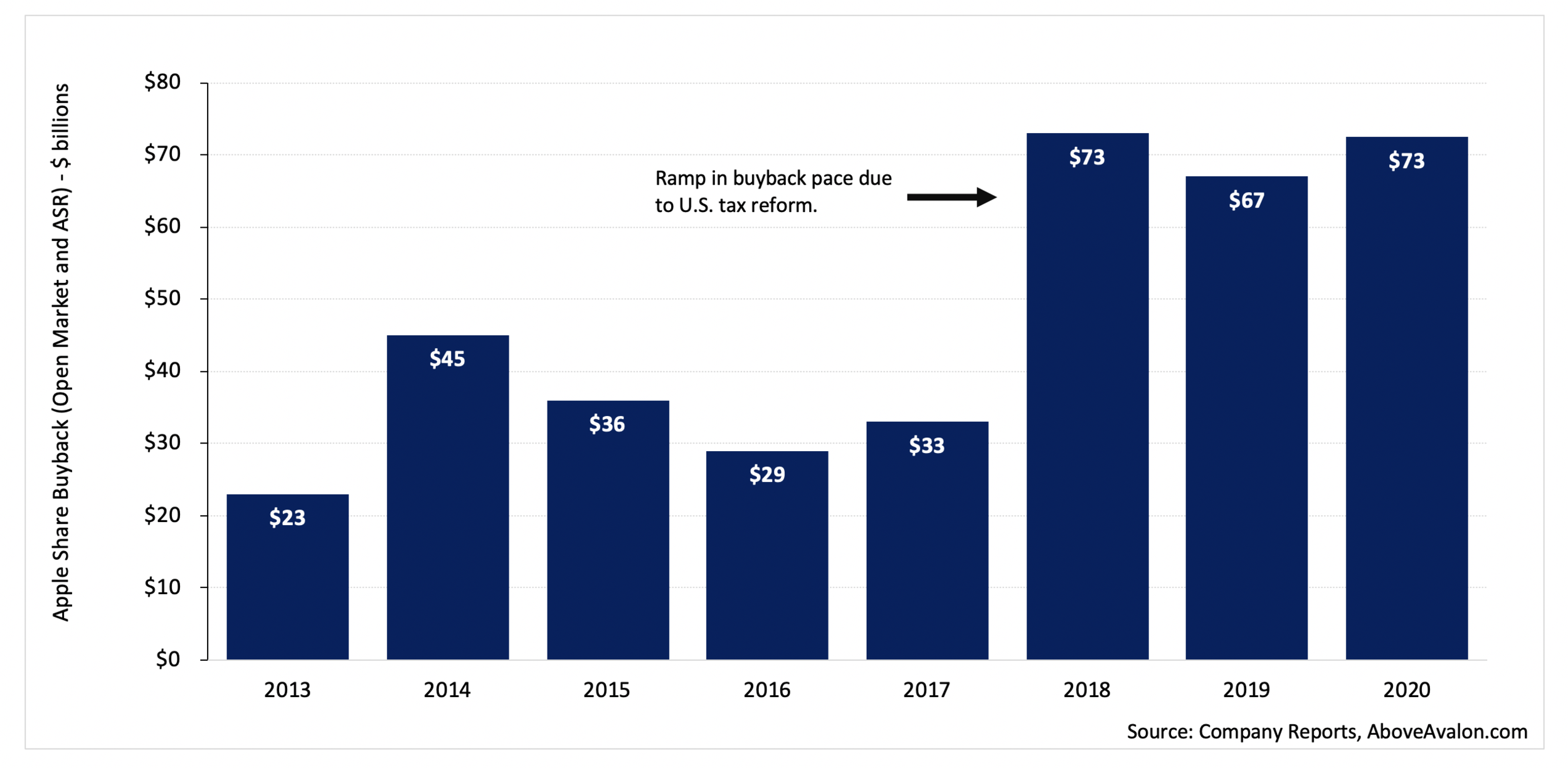

Stock Buybacks - What It Means When a Company Repurchases ... Stock buybacks, often referred to as share buybacks or share repurchases, are repurchases of stock in the open market by the issuing company. That's right, if Apple announces a share buyback, it means that the company plans on using some of its mounds of cash to buy its own stock back. What is a share buyback? | Share repurchase definition | IG SG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future. Learn how to trade stocks

What does BP share buyback mean? - Greedhead.net What do share buybacks mean? Stock buybacks refer to the repurchasing of shares of stock by the company that issued them. A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private investors.

What does share buyback mean

Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is... Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc. How Stock Buybacks Work and Why Companies Do Them - SmartAsset Reducing cash outflows and countering a potential undervaluing of shares are potential reasons. A stock buyback can mean many different things for investors. Make sure to examine the situation carefully and potentially. Also consider consulting with your financial advisor if a company you own stock in does a buyback. Tips for Stock Investing

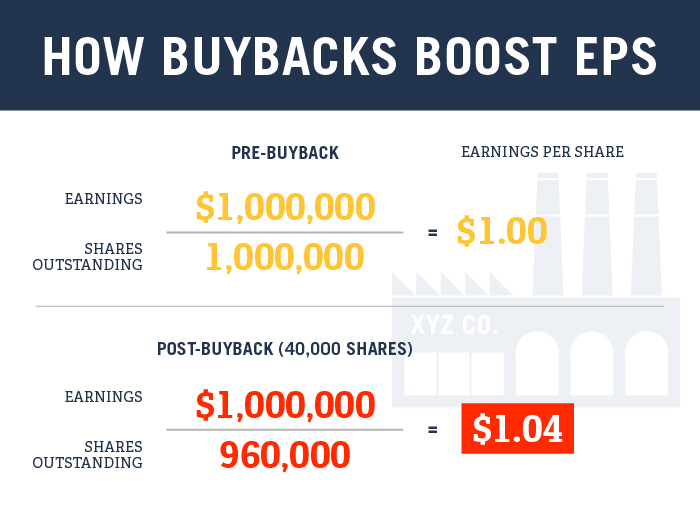

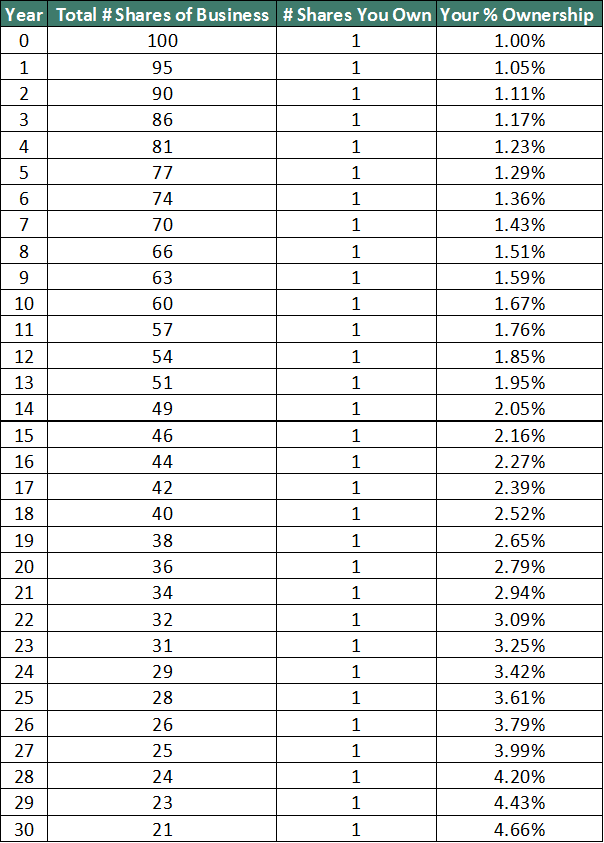

What does share buyback mean. 60 second guide: Share buybacks - CommBank A buyback is when a company offers to re-purchase some of its shares from existing shareholders. The net effect is a reduction in the total number of a company's shares on issue. This is generally seen as a way for companies to boost shareholder returns because after the buyback a company's profit will be spread across fewer shares. Share buyback financial definition of share buyback share buyback the purchase by a company of its own shares thereby reducing the amount of its ISSUED CAPITAL. Share buybacks are undertaken to return 'surplus' cash reserves to shareholders; more particularly they are undertaken to increase EARNINGS PER SHAREand DIVIDENDper share and thus (hopefully) lead to a rise in the company's share price. Share buy backs | ASIC - Australian Securities and ... A Notice of intention to carry out a share buy-back (Form 281) is also to be lodged with ASIC at least 14 days before the buy-back in the case of a buy-back (other than a minimum holding buy-back) which does not require lodgement of the buy-back documents, for example, an employee share buy-back or an on market buy-back either of which is under the 10/12 limit. How Stock Buybacks Work | The Motley Fool The buyback will take place at the lowest price that allows the company to buy back the desired number of shares, and all shareholders whose bids were at or below that price will receive the same...

What Is a Buyback? - The Balance A stock buyback occurs when a company buys outstanding shares of its own stock with excess cash or borrowed funds. A buyback increases the value of outstanding shares. It reduces the number of total shares on the market, which increases the earnings per share (EPS). One alternative is to pay dividends to investors. What is a Share Buyback? | Share Repurchase Definition - IG Share buyback, or share repurchase, is when a company buys back its own shares from investors. It can be seen as an alternative, tax-efficient way to return money to shareholders. Once shares are repurchased they are considered cancelled, but they can be kept for redistribution in the future. What The F**k Are Stock Buybacks (And What Do They Mean ... A buyback allows companies to invest in themselves. A company may feel its shares are undervalued and do a buyback to boost share price and give investors a return. And because the company is bullish on its current operations, a buyback also increases the proportion of earnings that a share is allocated. This will raise the stock price if the ... What Is Buyback of Shares - Meaning, Process, Reasons and ... For the longest time, the concept of share buy back remained buried under the Companies Act, 1956. It was the amendments to Sections 68, 69, and 70 of this Act that redefined and systematically put out the share buyback meaning and process.

Share Repurchase Definition - investopedia.com A share repurchase, or buyback, is a decision by a company to buy back its own shares from the marketplace. A company might buy back its shares to boost the value of the stock and to improve the... › share-buyback-advantagesShare Buyback - Advantages, Disadvantages, and How Does It ... The share buyback is when companies buy back their own shares from the shareholders. There are multiple logics and methods that why the companies opt for buying back. However, shareholder’s approval is required for the successful execution of the transaction. The methods and reasons for the implementation of the buyback program have been discussed in the following headings. What is a Stock Buyback? Definition & Benefits of Share ... A stock buyback (also known as a share repurchase) is a process when a company buys back its shares from the marketplace, therefore reducing the number of shares that are outstanding. Because there are fewer shares on the market, the value of each share increases, making each investor's stake in the company greater. What does TCS' buyback mean for its stock It has announced a buyback of up to 4 crore shares with the IT company buying shares at ₹ 4,500 per share. This is nearly 17%, premium compared to its last traded price of the stock on the NSE ...

What Is A Stock Buyback? - Forbes Advisor A stock buyback is when a public company uses cash to buy shares of its own stock on the open market. A company may do this to return money to shareholders that it doesn't need to fund operations...

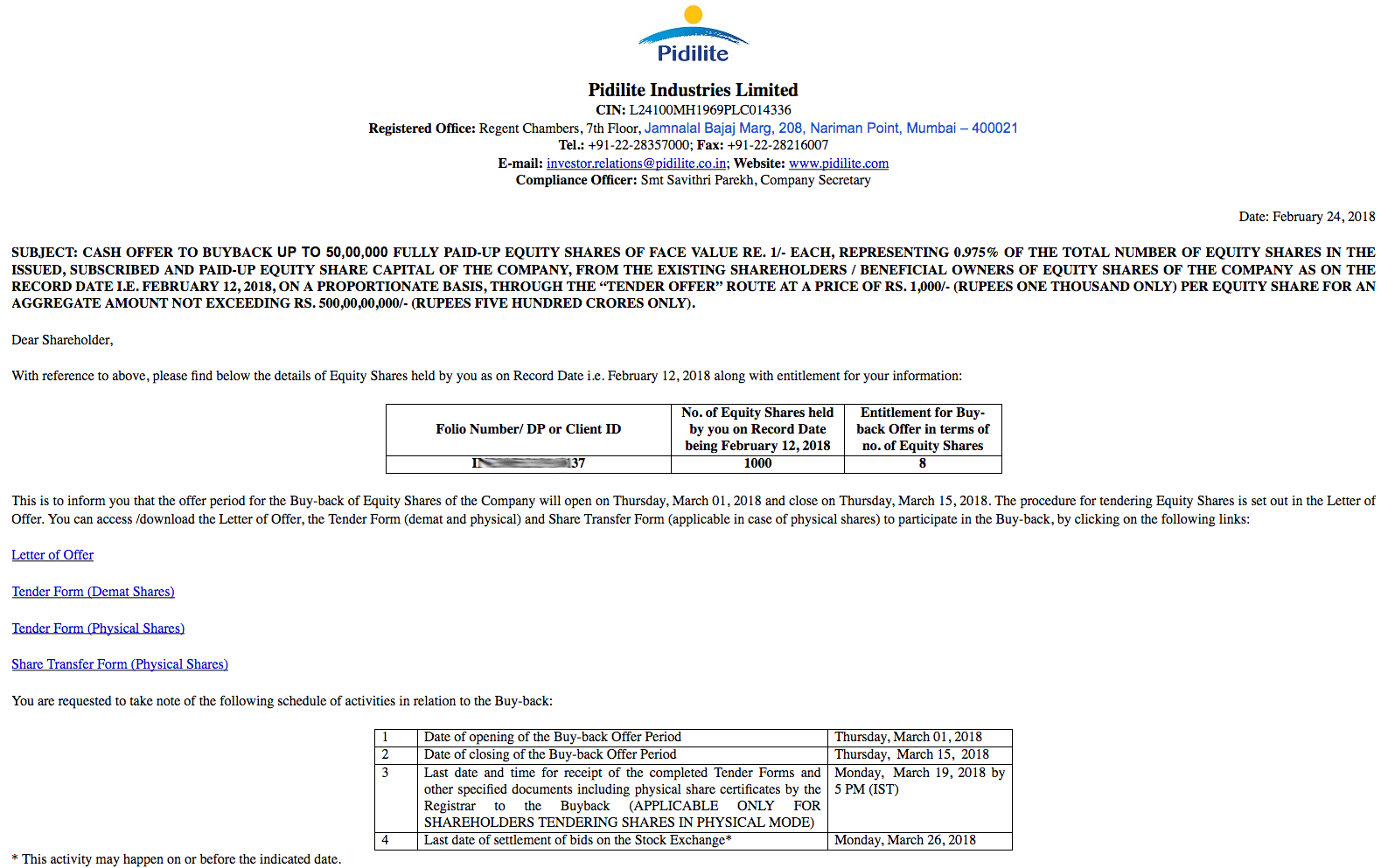

investinganswers.com › articles › what-stockWhat Stock Buybacks Mean to Investors | InvestingAnswers Jun 01, 2021 · Also called a share repurchase program, stock buybacks are a way a company returns wealth to the shareholder by purchasing outstanding shares of its own stock. A stock buyback is generally conducted in one of two ways: buying shares in the open market over time or tendering an offer to existing shareholders to buy shares at a fixed price

What is a share buy-back and how does it work? A share buy-back is a capital management strategy used by companies to return money to shareholders. In Australia, a share buy-back occurs when a company decides to repurchase shares from shareholders. These shares are then cancelled, reducing the number of shares on issue. Share buy-back programs are performed by a company either "on-market ...

Dividends vs. share buybacks | Hargreaves Lansdown What does it mean? Ideally, a share buyback will take place when the company's management thinks the shares are undervalued. This is one half of the basic 'buy low, sell high' mantra.

› ask › answersStock Buybacks: Why Do Companies Buy Back Shares? Jan 16, 2021 · A buyback occurs when the issuing company pays shareholders the market value per share and re-absorbs that portion of its ownership that was previously distributed among public and private...

Share Buybacks: What It Means And How It Impacts Investors A share buyback, or repurchase, is a move by a listed company to buy its own shares. This can be from the open market, issuing a tender offer, or arranging for a private buyback from a shareholder (s). Share buybacks are a corporate action that require companies to make a public filing with regulators.

Share Buyback (Definition, Examples) | Top 3 Methods Share buyback refers to the repurchase of the company's own outstanding shares from the open market using the accumulated funds of the company to decrease the outstanding shares in the company's balance sheet thereby raising the worth of remaining outstanding shares or to block the control of various shareholders on the company.

ELI5: What does "share buyback" or "share repurchase" mean ... It literally means what it says on the tin: the company is buying back the shares from their shareholders. Usually, they'll buy it back at a price that is significantly higher than the current share price so that investors would be willing to sell. Usually, companies will buy back as many shares as they can up to a certain value (in this case ...

What Are Share Repurchases? | The Motley Fool Both terms have the same meaning: A share repurchase (or stock buyback) happens when a company uses some of its cash to buy shares of its own stock on the open market over a period of time. Below,...

How Stock Buybacks Work and Why Companies Do Them - SmartAsset Reducing cash outflows and countering a potential undervaluing of shares are potential reasons. A stock buyback can mean many different things for investors. Make sure to examine the situation carefully and potentially. Also consider consulting with your financial advisor if a company you own stock in does a buyback. Tips for Stock Investing

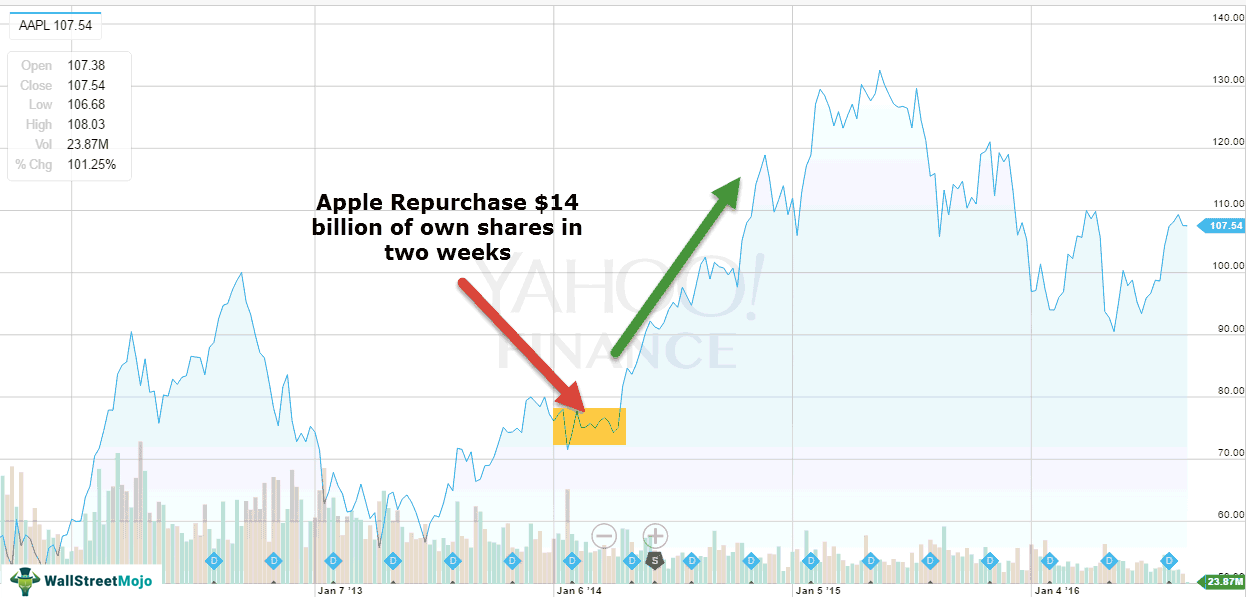

Share Repurchase - Overview, Impact, and Signaling Effect When a company buys back shares, it may be an indication that the company is facing very positive prospects that will place upward pressure on the stock price. Examples may be the acquisition of another strategically important company, the release of a new product line, a divestiture of a low-performing business unit, etc.

Share Buybacks - The Motley Fool UK As investing jargon goes a share buyback is one of the simplest terms. It's simply a company buying back its own shares. It can do this in one of two ways. The first, and by far the most common, is...

/why-would-company-buyback-its-own-shares_FINAL-dc32eefe564647ce9c66c345230fd0a9.png)

:max_bytes(150000):strip_icc()/Screenshot2020-04-14at11.17.32AM-6d8cfcd249bd4cfa94ba0343bc2f3426.png)

0 Response to "43 what does share buyback mean"

Post a Comment