41 notes payable asset or liability

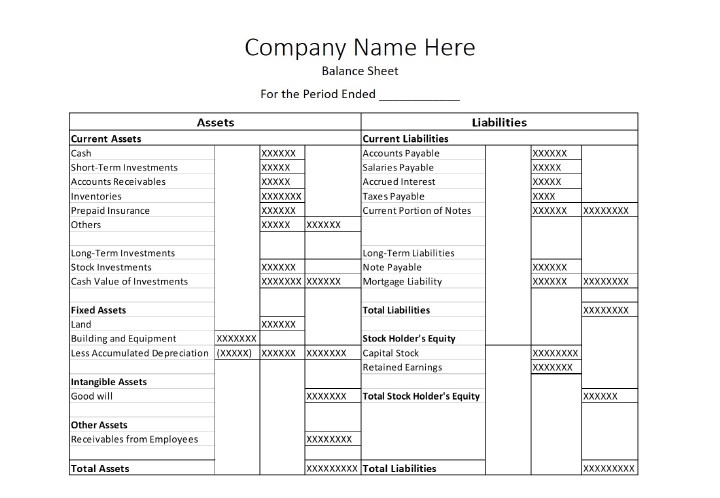

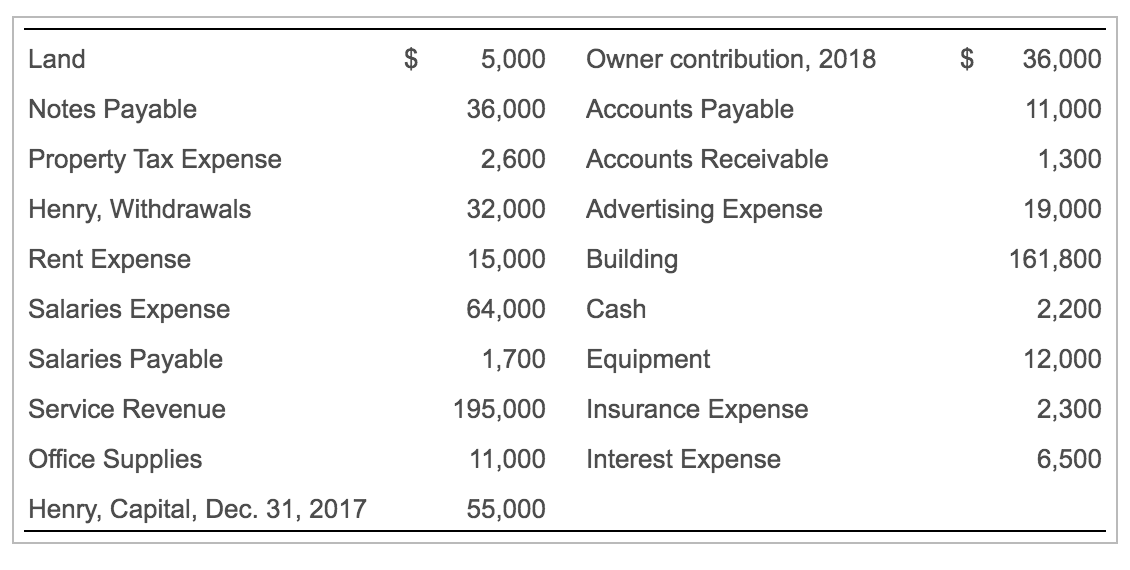

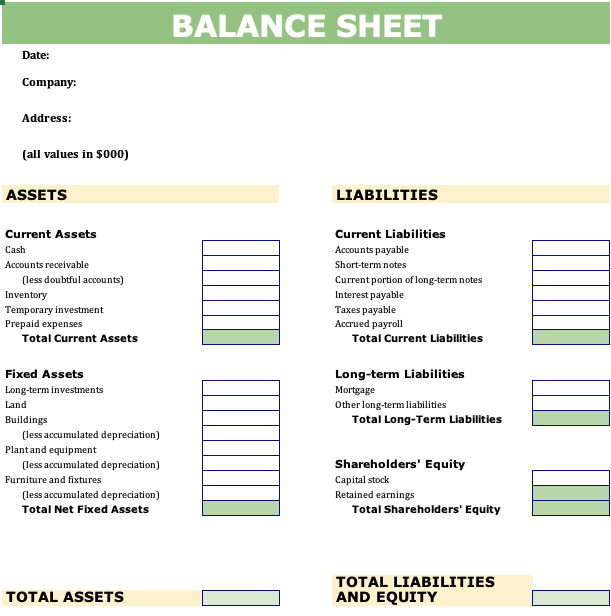

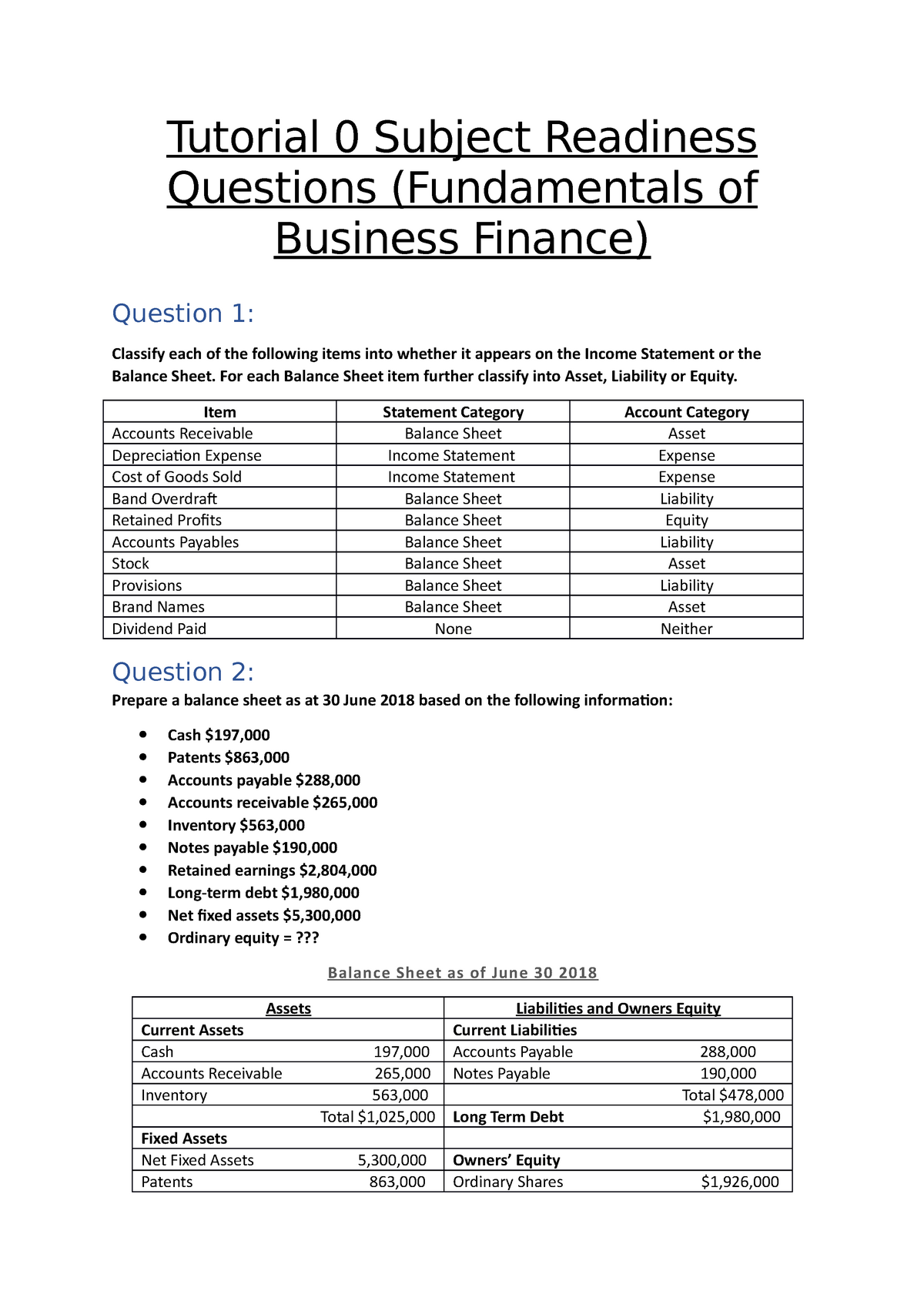

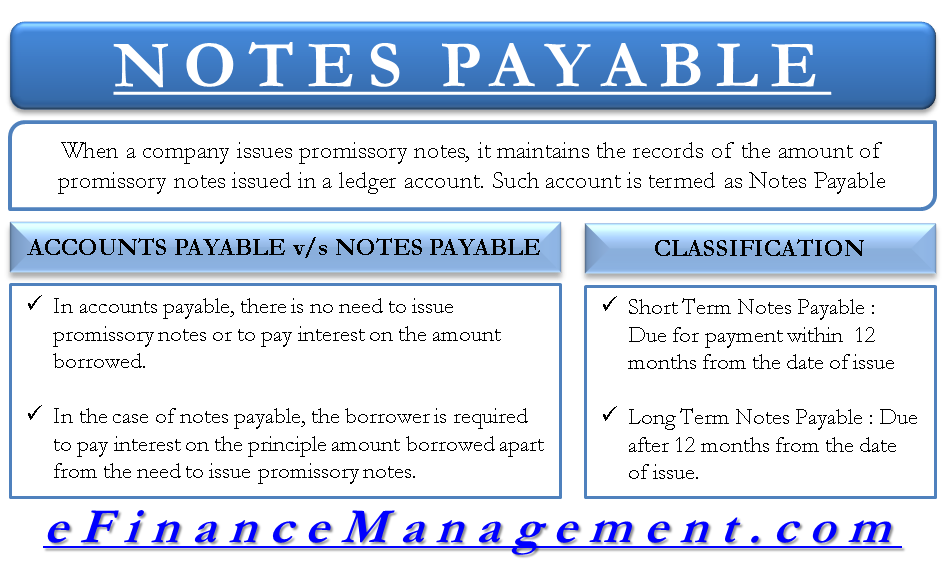

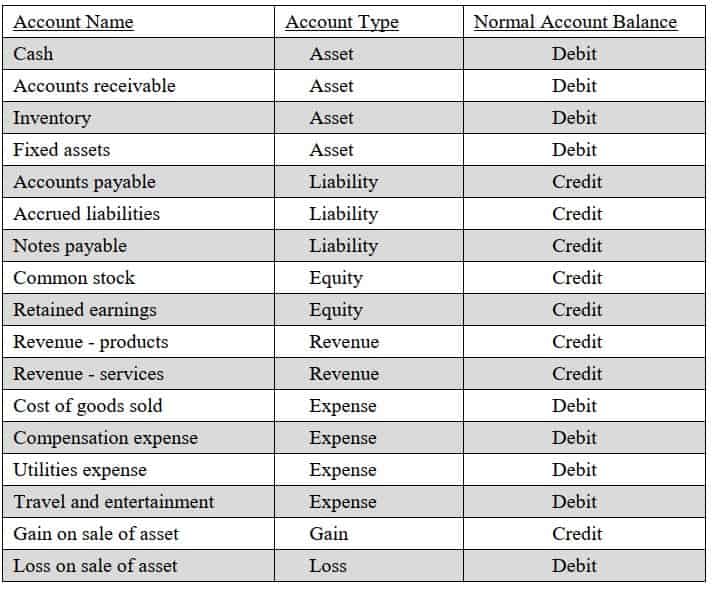

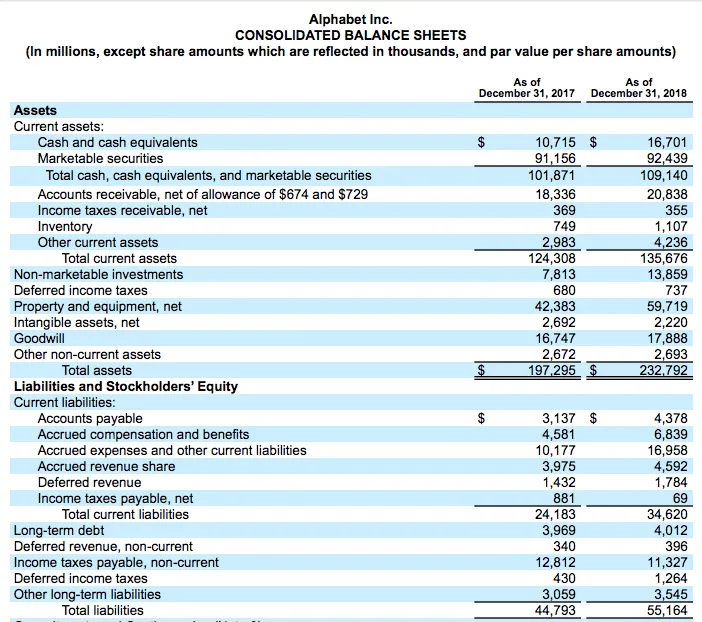

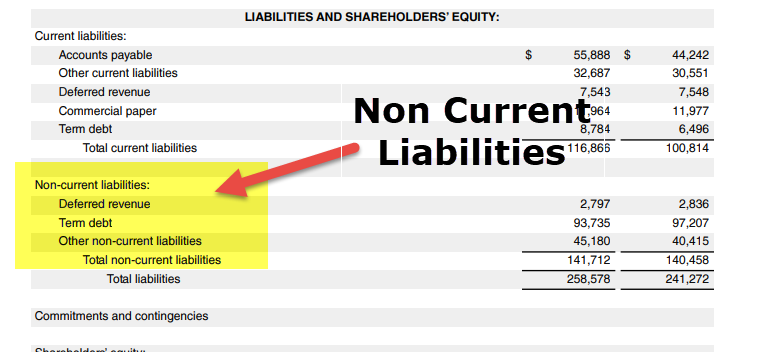

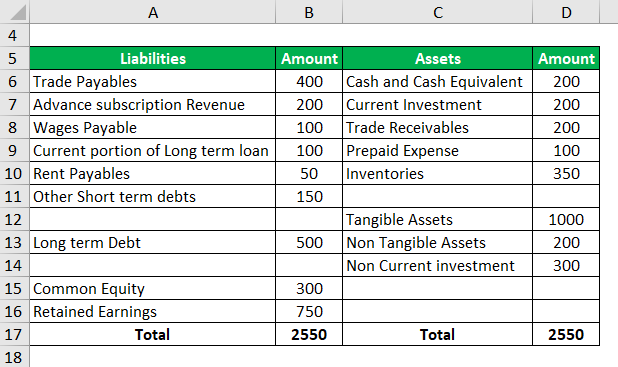

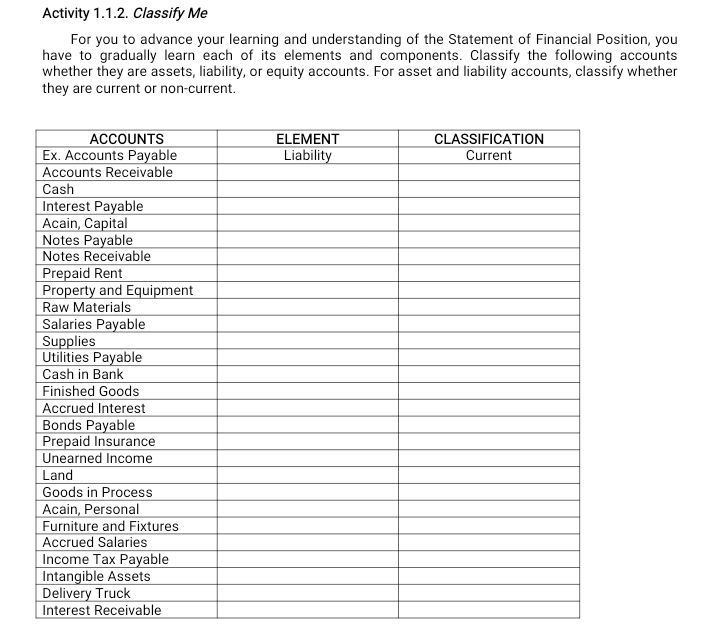

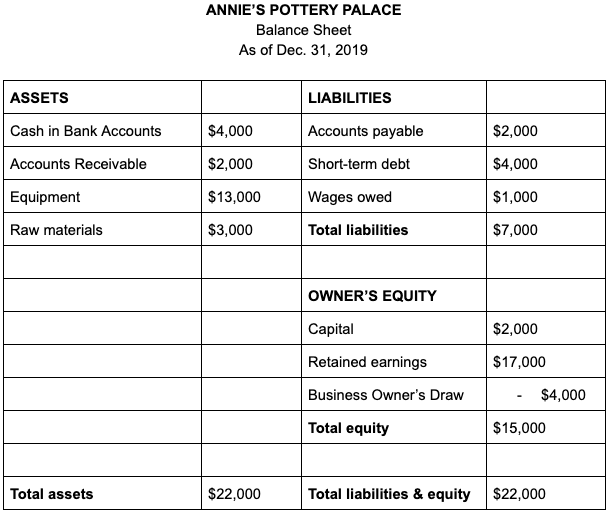

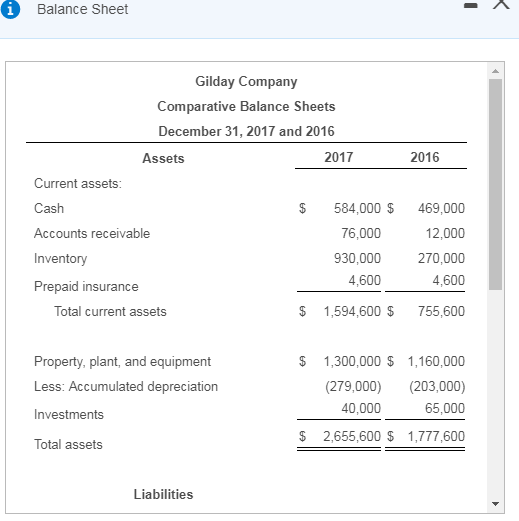

corporatefinanceinstitute.com › notes-payableNotes Payable - Learn How to Book NP on a Balance Sheet Notes payable appear as liabilities on a balance sheetBalance SheetThe balance sheet is one of the three fundamental financial statements. The financial statements are key to both financial modeling and accounting.. Additionally, they are classified as current liabilities when the amounts are due within a... Assets and liabilities - Article Assets - What your business owns. Assets are resources used to produce revenue, and have a future economic benefit. Liabilities include accounts payable and long-term debt. Equity - Equity is the difference between assets and liabilities, and you can think of equity as the true value of your...

Notes Payable Liability Or Asset Economic While Notes Payable is a liability, Notes … contingent liability footnote disclosure. › Verified 3 days ago. Details: In accounting, Notes Payable is a general ledger liability account in which a company records the face amounts of the promissory notes that it has issued.

Notes payable asset or liability

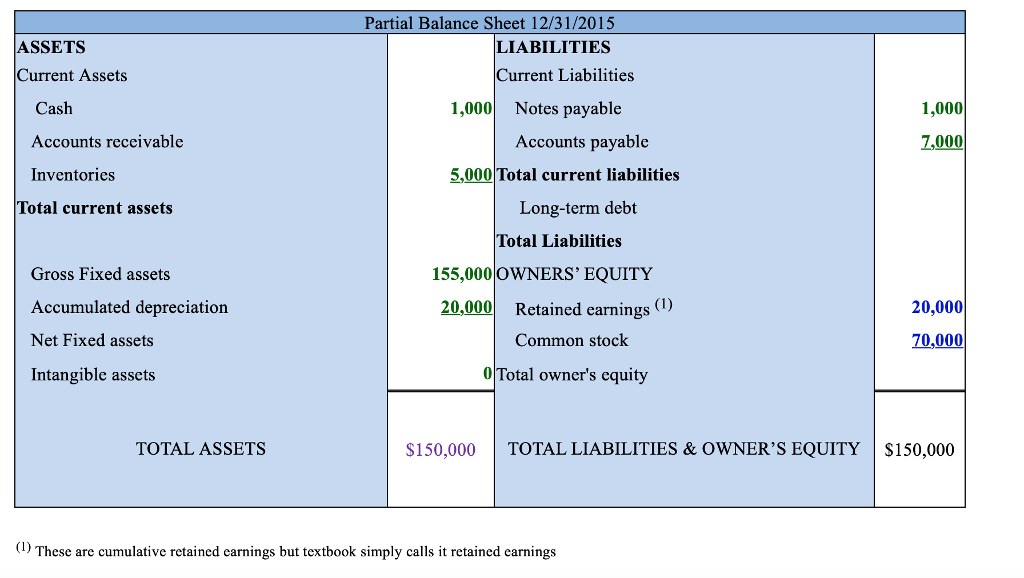

Are accounts payable assets, liabilities, or equity? - Wikiaccounting An asset can be thought of as something that, in the future, can generate cash flow, reduce expenses, or improve sales, regardless of whether it's The nature of accounts payable matches with current liabilities. The common characteristics below conclude why accounts payable is within current liability Elements of Accounting - Assets, Liabilities, and Capital Current liabilities include: Trade and other payables - such as Accounts Payable, Notes Payable, Interest Payable, Rent Payable, Accrued Income refers to an increase in economic benefit during the accounting period in the form of an increase in asset or a decrease in liability that results in increase... Longer Term Liabilities: Notes payable - YouTube In this session, I explain longer term liabilities: Notes payable Are you a CPA candidate or accounting student? Check my website for additional resources...

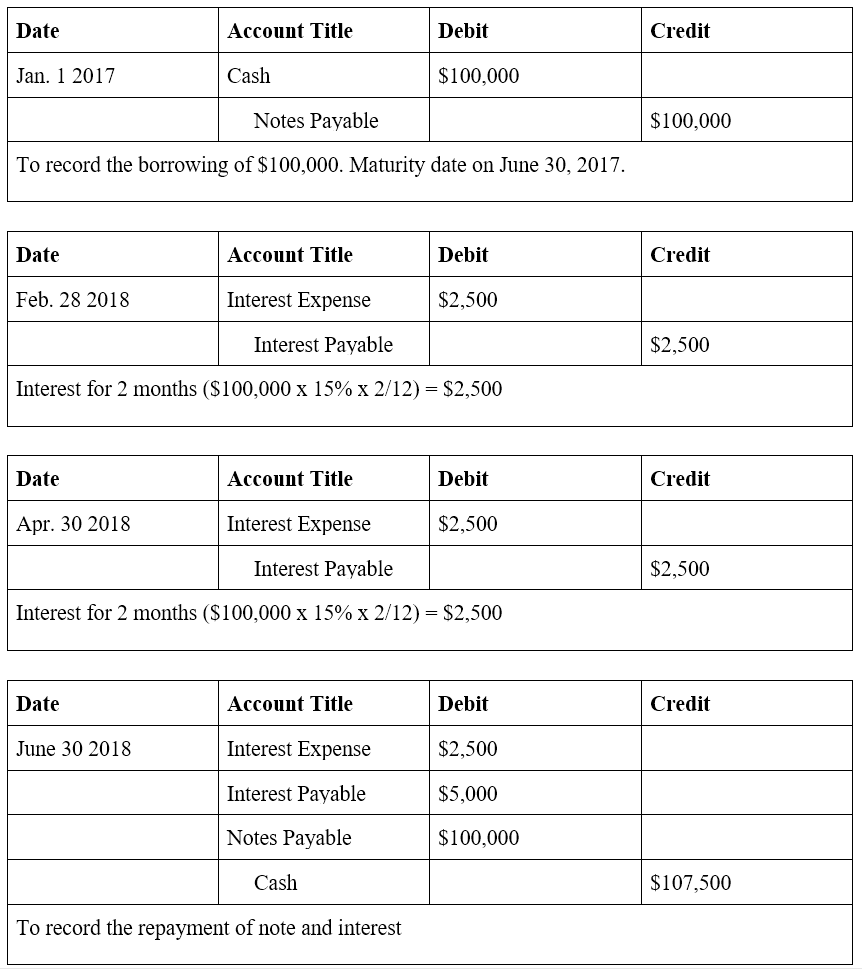

Notes payable asset or liability. What is the difference between Notes Payable and... | AccountingCoach Definition of Notes Payable The account Notes Payable is a liability account in which a borrower's written promise to pay a lender is recorded. The account Accounts Payable is normally a current liability used to record purchases on credit from a company's suppliers. Accounting Principles II: Understanding Notes Payable Understanding Notes Payable. A liability is created when a company signs a note for the purpose of borrowing money or extending its payment A note may be signed for an overdue invoice when the company needs to extend its payment, when the company borrows cash, or in exchange for an asset. How Do Accounts Payable Show on the Balance Sheet? Other current liabilities can include notes payable and accrued expenses. Current liabilities are differentiated from The Bottom Line. Accounts payable is considered a current liability, not an asset, on the balance sheet. Individual transactions should be kept in the accounts payable subsidiary ledger . The Difference Between Accounts Payable and Notes Payable Notes payable are typically used for buying fixed assets like equipment, plant facilities and property. Notes payable are designed to finance purchases of fixed assets such as equipment, buildings and property. They have formal agreements, a fixed payment schedule, a specific interest...

5.3: Notes Payable - Business LibreTexts ▲ Note Payable is a liability account that is increasing. Installment payments of $11,549 will be ▼ Cash is an asset account that is decreasing. Installments that are due within the coming year are Using the example above, Notes Payable would be listed on the balance sheet that is prepared at the... › terms › cContra Liability Account Definition - Investopedia Jul 31, 2021 · Contra Liability Account: A liability account that is debited in order to offset a credit to another liability account. The contra liability account is used to adjust the book value of an asset or ... Notes payable: Notes payable are tied to buying enterprise assets or... Accounts payable and notes payable are both documented as liabilities on a balance sheet but have stark differences that play a role in managing debt and Notes Payable vs Accounts Payable: What's the Difference? Taylor Pettis June 24th, 2021. As the saying goes, you have to spend money to make... What Are Assets, Liabilities, and Equity? | Bench Accounting Assets - Liabilities = Equity. The type of equity that most people are familiar with is "stock"—i.e. how much of a company someone owns, in the form of In order for the accounting equation to stay in balance, every increase in assets has to be matched by an increase in liabilities or equity (or both).

Is Accounts Payable A Liability Or An Asset? | PLANERGY Software As liabilities, accounts payable will appear on your balance sheet alongside related short-term and long-term debts. They are distinct from assets and also Note: Companies can also use accounts payable to purchase assets such as equipment, property, etc. In such a scenario, your accounts... › notes-payableNotes Payable Accounting | Double Entry Bookkeeping Mar 18, 2020 · Are notes payable interest bearing debt? Yes. A note payable is an interest bearing debt. Where is notes payable on balance sheet? A note payable is shown under either current or long term liabilities on the balance sheet. Is a note payable an asset? No. A note payable is a liability. Do notes payable go on an income statement? No. Classification Of Assets And Liabilities Current Liabilities: These are short-term liabilities and are payable within a year. Assets and liabilities definitions are assets are the items that a company owns and liabilities are items that a Students can prepare the topic assets and liabilities with the help of revision notes and important... Is notes payable an asset or a liability? - Quora Notes payable are liabilities. If you have a future cash outflow (you have to pay rent, mortgage, insurance, loans, etc) then you have a liability. Assets, on the other hand, are anything of value that can be converted to cash (property, accounts receivable, equipment, inventory).

Notes Payable - principlesofaccounting.com Notes Payable. Home. Chapter 12: Current Liabilities and Employer Obligations. When the note is repaid, the difference between the carrying amount of the note and the cash necessary to Next, consider how the preceding amounts would appear in the current liability section of the balance sheet...

Notes payable - explanation, journal... | Accounting For Management Notes payable. Posted in: Current liabilities (explanations). The note payable is a written promissory note in which the maker of the note makes an unconditional promise to pay a certain amount of money after a purchase plant, machinery, equipment, furniture or some other fixed assets.

› accounts-payableAccounts Payable - General Ledger Account | AccountingCoach The balance in Accounts Payable is usually presented as the first or second item in the current liability section of the balance sheet. (Many companies report Notes Payable due within one year as the first item.) As a liability account, Accounts Payable is expected to have a credit balance.

› accounts-payableAccounts Payable - Related Expense or Asset | AccountingCoach As a result these amounts will not have been entered into the Accounts Payable account (and the related expense or asset account). These documents should be reviewed in order to determine whether a liability and an expense have actually been incurred by the company as of the end of the accounting period.

Notes payable definition — AccountingTools A note payable is a written promissory note. Under this agreement, a borrower obtains money from a lender and promises to pay it back with A note payable is classified in the balance sheet as a short-term liability if it is due within the next 12 months, or as a long-term liability if it is due at a later date.

Accounts Payable Vs. Notes Payable (With Examples) - Zippia Notes payable is a liability account maintained in a company's general ledger that tracks their promises to pay specific amounts of money within a predetermined period. Companies short on cash may issue promissory notes to vendors, banks, or other financial institutions to acquire assets or...

What are Assets and Liabilities? Different types of Assets and... Assets. The term 'asset' signifies all kinds of resources that help generate revenue as well as Consequently, it can be said -. Formula: Total assets = Liabilities (accounts payable) + Owner's Liabilities. The term liability signifies all types of account payables. It can further be defined as a...

Accounts Payable vs Notes Payable | Top 6 Differences You Should... Notes payable on the other hand can be referred to as the written promissory note to repay the amount borrowed from the lender that specifies the specific amount which is required to be paid at a future date or when demanded. When the funds are borrowed from the lender, then the liability is created by the...

What Are Notes Payable and How Do Companies Use Them? Short-term notes payable fall under current liabilities, and long-term notes payable fall under long-term liabilities. If the lender was to categorize notes receivable on their own balance sheet, it would be considered either a current or non-current asset depending on the term length.

Right Difference Between Accounts Payable and Notes Payable Notes payable are the written promissory notes that a company receives when it borrows money. For example, a company borrows $10,000 from a bank. If a company plans to repay its notes payable within one year, it includes it in the balance sheet as a current liability.

What Is Notes Payable? (With Examples) | Indeed.com Notes payable is a liability account where a borrower records a written promise to repay the lender. When carrying out and accounting for notes payable, "the maker" of the note creates liability by borrowing from another entity, promising to repay the payee with interest. Then, the maker records the...

Is notes payable an asset or a liability? - Answers Accounts Payable and Notes Payable are liabilities. Accounts receivable - assets All "payable" accounts are "liabilities". This is because a liability is something the company OWES, a payable is the very same thing, hence the term "payable".

corporatefinanceinstitute.com › notes-receivableWhat are Notes Receivable? - Examples and Step-by-Step Guide Notes Payable is a liability as it records the value a business owes in promissory notes. Notes Receivable are an asset as they record the value that a business is owed in promissory notes. A closely related topic is that of accounts receivable vs. accounts payable. Additional Resources. Thank you for reading our guide to Notes Receivable.

› notes-payableNotes Payable on Balance Sheet (Definition, Journal Entries) Short-Term Notes Payable. Firstly, the company puts notes payable as a short-term liability. The company puts it as a short-term liability when the duration of that particular note payable is due within a year. As we see from the above example, CBRE has a current portion of notes of 133.94 million and $10.26 million in 2005 and 2004, respectively.

Difference Between Assets and Liabilities... - Key Differences Key Differences Between Assets and Liabilities. As we have discussed the meaning and important points of these two heads of the balance sheet. Long Term Provisions: Provision for liability which is expected to be payable not within 12 months from the date on which the balance sheet is prepared.

Accounts Payable vs. Notes Payable - Head to Head Difference The primary difference between Accounts Payable vs. Notes Payable is that the former is the amount owed by the company to its supplier when any goods are purchased or services are availed, whereas the latter is the written promise for giving a specific sum of money at a specified future date or as per...

Common Stock Asset or Liability: Everything You Need to Know Notes Payable. These are short-term loans, usually with interest, owed to a creditor. Like assets, liabilities can be classified as either current or long-term. These are obligations that are anticipated to be paid at some point beyond one year or one operating cycle.

Longer Term Liabilities: Notes payable - YouTube In this session, I explain longer term liabilities: Notes payable Are you a CPA candidate or accounting student? Check my website for additional resources...

Elements of Accounting - Assets, Liabilities, and Capital Current liabilities include: Trade and other payables - such as Accounts Payable, Notes Payable, Interest Payable, Rent Payable, Accrued Income refers to an increase in economic benefit during the accounting period in the form of an increase in asset or a decrease in liability that results in increase...

Are accounts payable assets, liabilities, or equity? - Wikiaccounting An asset can be thought of as something that, in the future, can generate cash flow, reduce expenses, or improve sales, regardless of whether it's The nature of accounts payable matches with current liabilities. The common characteristics below conclude why accounts payable is within current liability

/dotdash_Final_What_Changes_in_Working_Capital_Impact_Cash_Flow_Sep_2020-01-13de858aa25b4c5389427b3f49bef9bc.jpg)

/dotdash_Final_Current_Liabilities_Sep_2020-01-6515e265cfd34787ae2b0a30e9f1ccc8.jpg)

0 Response to "41 notes payable asset or liability"

Post a Comment