43 changes to defined benefit pensions

› pers › PagesState of Oregon: Public Employees Retirement System ... PERS provides some online publications in .pdf format. To view them, you must have the most recent version of Adobe Reader ®. Download the latest version of Adobe Reader ®. WHY HAVE DEFINED BENEFIT PLANS SURVIVED IN THE ... by AH Munnell · Cited by 52 — 9 The Pension Protection Act of 2006 represents the most significant change in pension regulation since the Employee Retirement Income Security Act of 1974 ( ...12 pages

Defined benefit pension schemes: questions and answers How will the employers' legal obligations change in 2012? 5. What is Financial Reporting Standard 17? 6. Who Regulates Pension Schemes?8 pages

Changes to defined benefit pensions

Defined benefit pension transfers - Aviva 19.05.2021 · Defined benefit pensions give you a guaranteed amount of income for life, meaning you can’t take more or less money if your circumstances change. A defined contribution pension, however, gives you full flexibility once you turn 55. You can use your savings to buy a guaranteed income (annuity) for life, withdraw your money as and when you need it, or get an income from … The shift from defined benefit to defined contribution pension ... by J Broadbent · 2006 · Cited by 149 — Traditionally, most pension plans were structured to provide the employee with a life annuity at retirement. This is gradually changing, however.59 pages en.wikipedia.org › wiki › Defined_contribution_planDefined contribution plan - Wikipedia A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account.

Changes to defined benefit pensions. Home - Civil Service Pension Scheme Introducing the new Civil Service Pensions Website. We have totally redesigned and rebuilt our website from the ground up. Our aim was to make it easier and quicker than ever for you to find the information and support you need to manage, understand and maximise the benefits of your biggest employment benefit after your salary – your Civil Service Pension. Co-op Pensions Website Welcome to the pensions website for the Co-op Section of Pace. Co-op Pension Portal Changes to Pace DC investments . We’ve make changes to the funds offered to members. We’ve introduced a new fund to the “default” option that applies if you haven’t made an investment choice yourself, and made changes to the self-select fund range. New joiners to Pace DC … Recent executive compensation and fringe benefit changes 01.12.2021 · EMPLOYEE BENEFITS & PENSIONS; Recent executive compensation and fringe benefit changes By Veena K. Murthy, J.D., LL.M. (Taxation), and Jacqueline McCumber, CPA, J.D. IMAGE BY MEDIAPHOTOS/ISTOCK . Related. TOPICS. Employee Benefits; Tax Planning; Tax Minimization : EXECUTIVE SUMMARY : The law known as the Tax Cuts and Jobs Act … Log In / Register - RPS Paying into a defined benefit pension. 3 things you must do My benefits AVCs: boosting my benefits Your tax limits Looking after your loved ones Life changes Forms Work out your costs Leaving the Scheme Transferring your pension. No longer paying into a defined benefit pension . My benefits Looking after your loved ones Life changes Forms My options. Paying into IWDC. …

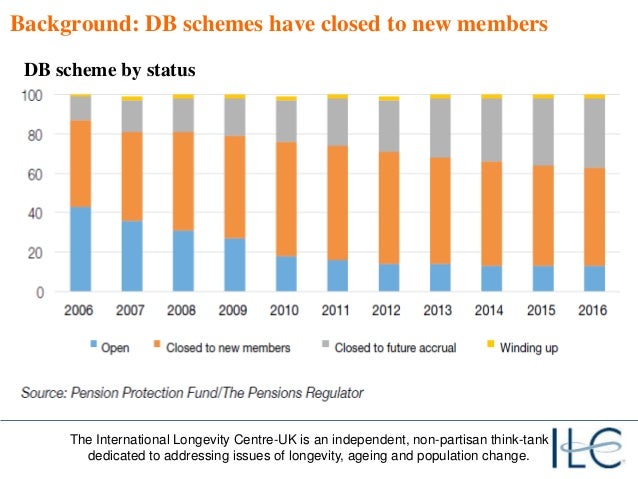

Pension - Wikipedia Defined benefit pensions tend to be less portable than defined contribution plans, even if the plan allows a lump sum cash benefit at termination. Most plans, however, pay their benefits as an annuity, so retirees do not bear the risk of low investment returns on contributions or of outliving their retirement income. The open-ended nature of these risks to the employer is the reason … Evolution of employer-provided defined benefit pensions by EB Levels · 1991 · Cited by 59 — can Express employees has changed greatly over the last century. This article briefly describes the evolution of typical modern pension plans, such.8 pages Pensioners revolt: Patrick Drahi winds up Sotheby’s ... 09.02.2022 · The Sotheby’s defined benefit scheme was closed to new members more than 15 years ago (2004), and fully closed back in 2016—later than many other, similar schemes. In line with current best ... Colorado PERA Defined Benefit Plan; Option to Choose Plan; Mid-Career; Ready to Retire. When Can I Retire? How to Retire; Benefit Basics. Highest Average Salary (HAS) Tables; Member Contribution Rates; Purchasing Service Credit; Social Security; Tax-Deferred Interest; Life and Job Changes. Leaving Employment ; Divorce/Domestic Relations Orders; Disability; Survivor Benefits; Life …

en.wikipedia.org › wiki › Defined_contribution_planDefined contribution plan - Wikipedia A defined contribution (DC) plan is a type of retirement plan in which the employer, employee or both make contributions on a regular basis. Individual accounts are set up for participants and benefits are based on the amounts credited to these accounts (through employee contributions and, if applicable, employer contributions) plus any investment earnings on the money in the account. The shift from defined benefit to defined contribution pension ... by J Broadbent · 2006 · Cited by 149 — Traditionally, most pension plans were structured to provide the employee with a life annuity at retirement. This is gradually changing, however.59 pages Defined benefit pension transfers - Aviva 19.05.2021 · Defined benefit pensions give you a guaranteed amount of income for life, meaning you can’t take more or less money if your circumstances change. A defined contribution pension, however, gives you full flexibility once you turn 55. You can use your savings to buy a guaranteed income (annuity) for life, withdraw your money as and when you need it, or get an income from …

0 Response to "43 changes to defined benefit pensions"

Post a Comment